The extremely poor people have traditionally been left out of microcredit services because of self-exclusion, social-exclusion or institutional exclusion. The basic reasons for this exclusion are vulnerable socio-economic conditions of the extremely poor and a lack of self-confidence, initiatives and support. In such a reality, PKSF launched its microcredit program for the extremely poor in 2004 to include those excluded from traditional financial services. PKSF implements the ‘BUNIAD’ program to serve the extremely poor people. Later in 2014 the program was renamed `BUNIAD’.

IN FY 2024-25

LOAN DISBURSED TO POs

BDT 4.81 Billion

LOAN OUTSTANDING WITH POs

BDT 6.47 Billion

AT A GLANCE

IN FY 2024-25

0.50 Million

BORROWERS

FROM POs TO BORROWERS

LOAN DISBURSEMENT

BDT 15.42 Billion

LOAN OUTSTANDING

BDT 8.49 Billion

AVERAGE LOAN SIZE

BDT 0.031 MILLION

The program provides the extremely poor with financial and non-financial services to enable them to create a foundation for sustainable income opportunities and ensure their human dignity. Microcredit for Hardcore Poor (BUNIAD) offers distinctive flexibilities to the extremely poor in terms of deposit and withdrawal of savings, loan repayment schedules, attendance in group meetings and minimum savings requirement for a fresh loan. Moreover, PKSF provides Disaster Management Loan and Land Lease Loan to the ‘Buniad’ Participants.

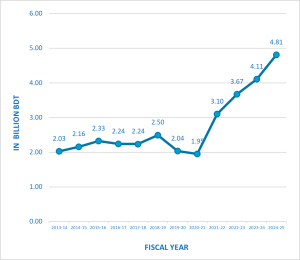

TREND OF LOAN DISBURSEMENT UNDER BUNIAD

(PKSF to Partner Organizations