Rural Microcredit (RMC), the primary loan programme of PKSF focuses broadly on rural development. The purpose of the programme is to provide credit in favor of off-farm activities with the objective of diversifying income opportunities of the rural poor. With gradual expansion of RMC, on-farm activities have also been incorporated.

Rural Microcredit (RMC), the primary loan programme of PKSF focuses broadly on rural development. The purpose of the programme is to provide credit in favor of off-farm activities with the objective of diversifying income opportunities of the rural poor. With gradual expansion of RMC, on-farm activities have also been incorporated.

It is difficult for the majority of the rural poor to access any formal financial organization. Since its inception, PKSF has relentlessly tried to address this hurdle with the help of its Partner Organizations (POs). Under RMC, loans have been made available with the minimum required formalities in the rural areas through the POs. The target group of RMC is the rural poor who own arable land of less than 50 decimals or total assets worth not more than the value of one acre of land. Under RMC, the borrowers are provided funds used in undertaking family-based Income Generating Activities (IGAs).

People from similar economic strata tend to have confidence and trust for each other, motivating them to form organized groups This solidarity approach usually make repaymenteasy and borrower-friendly. The administrative and related expenses of RMC implementing POs are covered by the service charges paid by the borrowers.

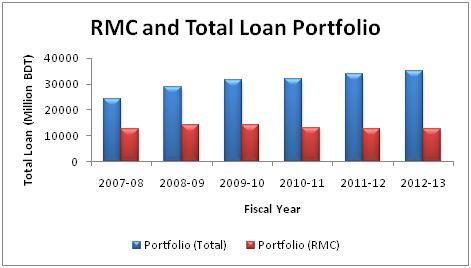

In FY 2012-13, PKSF’s disbursement to its POs under RMC was BDT 6027.70 million, with an outstanding loan of BDT 12680.08 million. POs disbursed BDT 64804.22 million to the borrowers and were left with an outstanding loan of BDT 33224.92 million (Figure 7.0 & 8.0). Although PKSF’s disbursement, in FY 2012-13, to its POs under RMC increased by 2.90% from that of the previous FY, the POs’ disbursement to borrowers increased by 7.88%. This indicates a large rotation of loans by POs under this programme. In FY 2012-13, the total number of RMC borrowers stood at 4.29 million, constituting to 73% of the total members under this loan programme. As of June 30, 2013, the average loan size under this programme stood at BDT 16,325. RMC still dominates PKSF’s loan portfolio with its Partner Organizations (36%).