The extension of financial services to the poor community is increasingly becoming very important as a means of poverty reduction interventions. Some areas of the country still lack access to financial support. The Agricultural sector is one such area financial service providers are not inclined to support. The high degree of risk involved in this sector is one of the main reasons for this aversion. In view of the demands and constraints of this particular sector, PKSF started the Micro Finance for Marginal and Small Farmer Project (MFMSFP) in 2005. The success of this project led PKSF to design and introduce the Agriculture Sector Microcredit (ASM) Programme in 2008. It has been proved to be mutually profitable for the farmers and Micro-Finance Institutes (MFIs).

ASM selects beneficiaries with special care. Attention is given to the timely disbursement of credit. Repayment of loan starts after harvesting, and interest is relatively low.

ASM offers comprehensive training programmes for the farmers and staff of the MFIs to develop their capacity in agricultural lending. To improve ASM , attention is given to rigorous research, development of high-yielding seed, management of irrigation, optimum use of pesticides, mechanized and technology-based farming, and vocational education to produce skilled human resources and increased productivity.

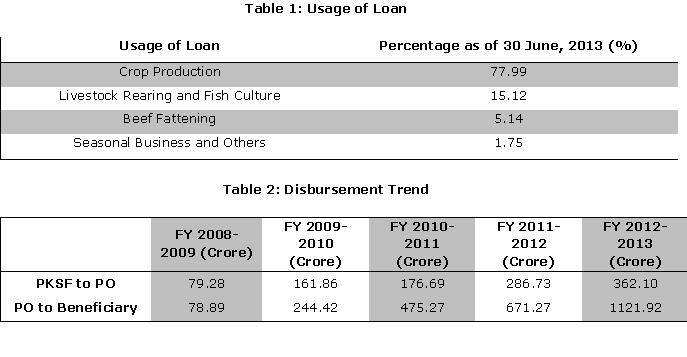

Under the ASM programme, PKSF disbursed BDT 3.62 billion, 96.79% of the programme budget, to concerned POs during FY 2012-13. On the other hand, POs disbursed a total of BDT 11.22 billion to their beneficiaries. As of June 2013, loan outstanding at the PKSF-PO level and PO-beneficiary level stood at BDT 2.12 billion and BDT 4.52 billion, respectively.