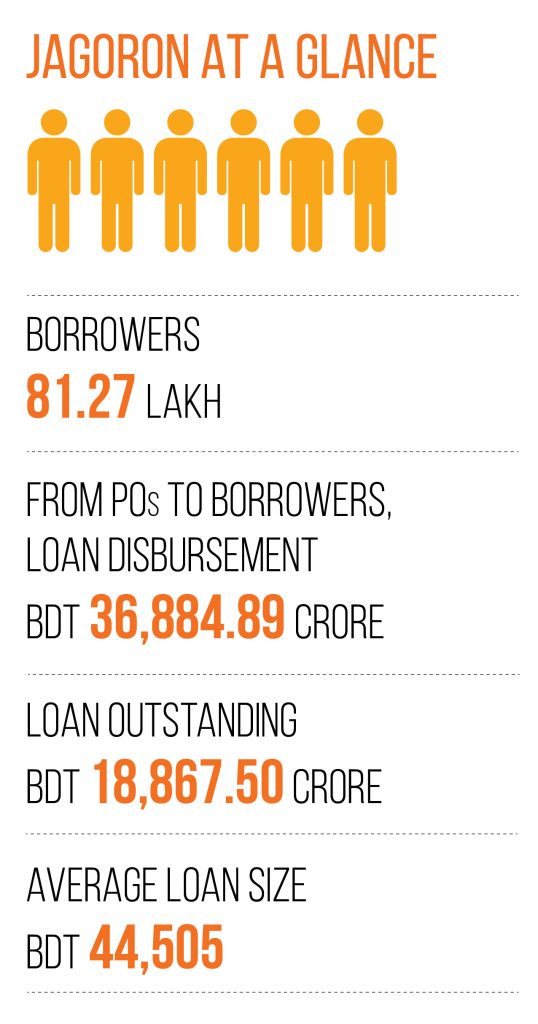

Jagoron, a credit program of PKSF, seeks to initiate household-based enterprise development in rural and urban areas of Bangladesh. Since October 1990, PKSF has been providing financial services for the rural poor under the Jagoron program (earlier known as Rural Microcredit). Though in the beginning, PKSF’s services were confined to the rural areas, PKSF in 1999 expanded its services to the urban poor as well.

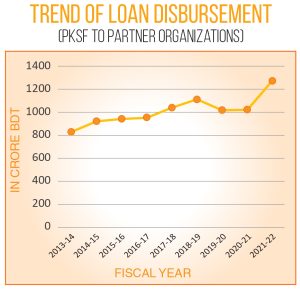

In urban areas, participation of women in the ‘Jagoron’ program is higher compared to their rural counterparts since urban women have higher participation in the labour market, greater access to resources, greater mobility and meaningful role in the household’s decision-making processes. Up to June 2022, the cumulative loan disbursement from PKSF to POs was BDT 16,874.35 crore and from POs to borrowers was BDT 2,37,703.25 crore.