To ensure sustainable poverty alleviation, there is no alternative to enterprise development. With this realization, PKSF launched its Enterprise Development Program in 2001. Later, the program was renamed ‘AGROSOR’. Any business activity with an investment of up to BDT 1.5 million (excluding land and building values) is eligible for availing from ‘AGROSOR’ assistance. An individual entrepreneur can take loan of up to BDT 1.0 million under the program.

IN FY 2024-25

LOAN DISBURSED TO POs

BDT 38.08 BILLION

LOAN OUTSTANDING WITH POs

BDT 66.59 BILLION

AT A GLANCE

IN FY 2024-25

BORROWERS 3.50 MILLION

FROM POs TO BORROWERS

LOAN DISBURSEMENT BDT 726.20 BILLION

LOAN OUTSTANDING BDT 416.15 BILLION

AVERAGE LOAN SIZE BDT 0.201 MILLION

PKSF’s activities for microenterprise development have already expanded widely within the country. The interventions supported through this program range from farm-based activities like honey production, dairy production, livestock rearing and floriculture to off-farm microenterprises such as hollow block manufacturing, mini garments, shoe making etc.

In addition, the world Bank has identified PKSF as the world’s largest microenterprise-financing Institutions.

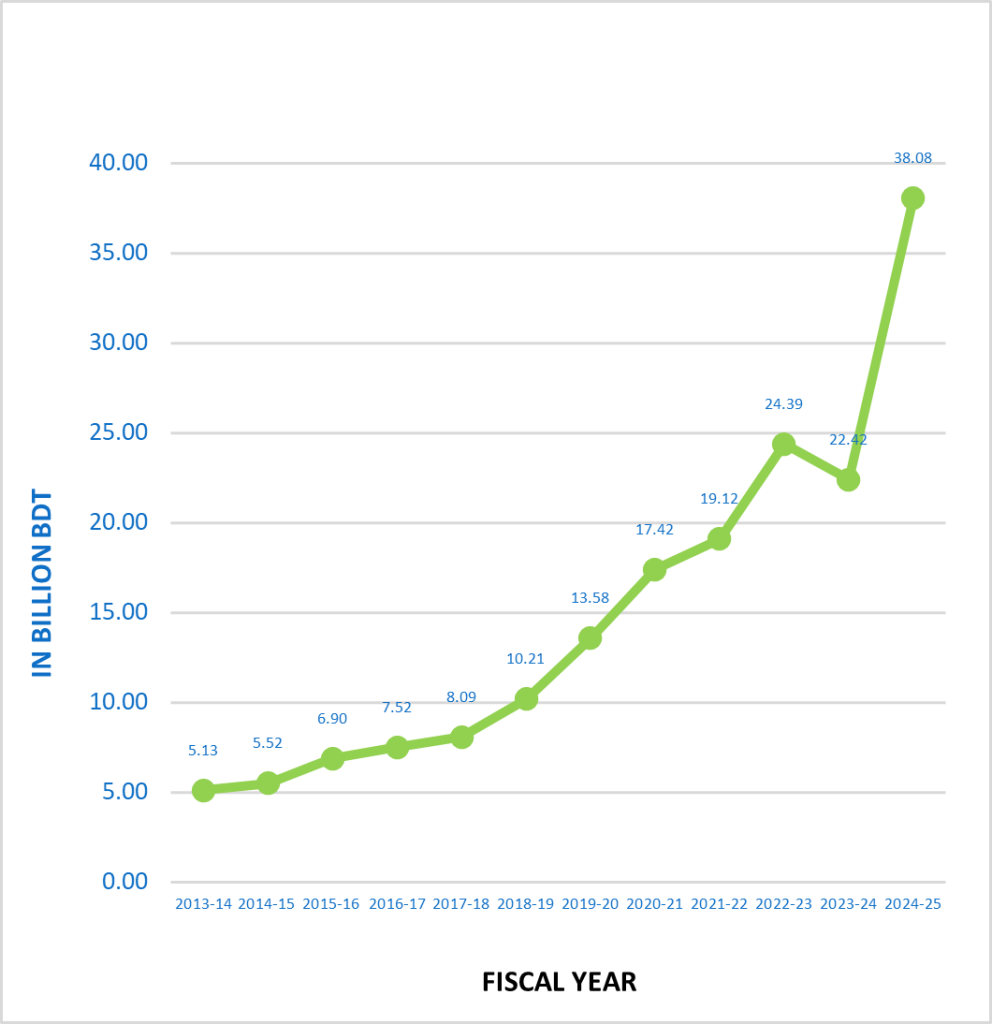

TREND OF LOAN DISBURSEMENT UNDER AGROSOR

(PKSF to Partner Organizations)