PKSF launched ‘Microfinance for Marginal and Small Farmers Project (MFMSFP)’ in 2005. The success of this project led PKSF to design and introduce a new program named ‘Agriculture Sector Microcredit’ in 2008. Earlier in 2006, PKSF launched the ‘Seasonal Loan Program’ to offer financial services to farmers to meet their seasonal needs. Later, in 2014, the two programs were merged and named ‘Sufolon’. Its unique financial services have created tremendous impetus for investment in different IGAs including crop cultivation and processing, livestock, fisheries, agro-forestry, agro-processing etc.

The key features of ‘Sufolon’ are provision for flexible repayment such as one shot, seasonal or balloon repayment consistent with the seasonal agricultural activities; and flexibility of availing multiple loans to diversify production.

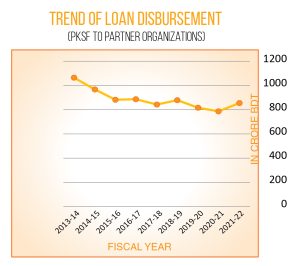

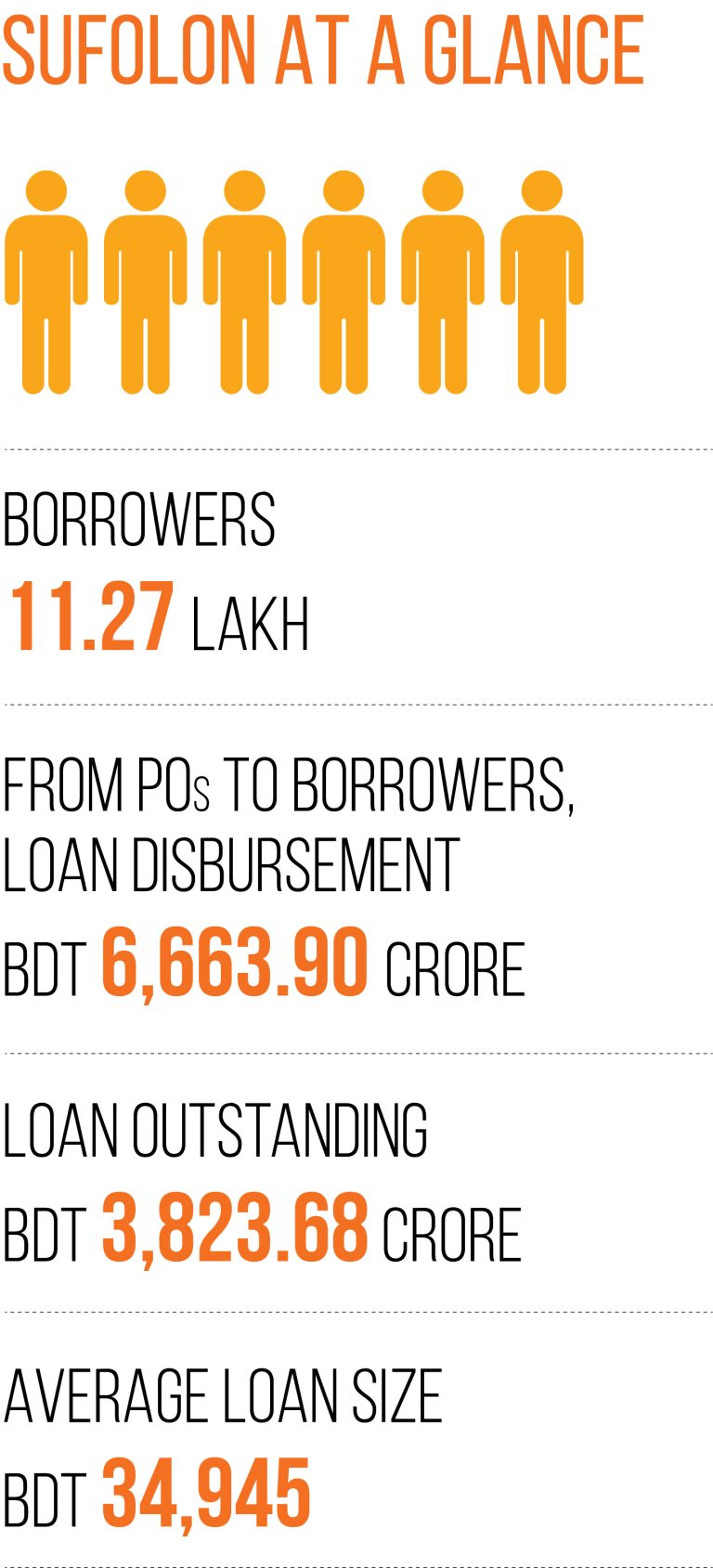

Such farmer-friendly terms have made the loan product very popular among borrowers. Up to June 2022, the cumulative loan disbursement from PKSF to POs stood at BDT 11,299.61 crore and from POs to borrowers at BDT 45,811.30 crore.