Poor people living in metropolitan areas are defined as the urban poor. In 1999, PKSF extended its microfinance services for the urban poor through Urban Microcredit (UMC) programme. Urban microcredit borrowers are distinct from the rural borrowers in a number of ways. They are the landless squatters living in slums or make-shift shacks. They usually take loans for small businesses. In Bangladesh, the number of urban poor has gradually increased in the last few years due to forced migration: a result oflimited employment opportunities in the rural agriculture sector, and repeated occurrences of natural disasters. As urban poverty continues to increase urban life and development becomes drastically hindered. .

Poor people living in metropolitan areas are defined as the urban poor. In 1999, PKSF extended its microfinance services for the urban poor through Urban Microcredit (UMC) programme. Urban microcredit borrowers are distinct from the rural borrowers in a number of ways. They are the landless squatters living in slums or make-shift shacks. They usually take loans for small businesses. In Bangladesh, the number of urban poor has gradually increased in the last few years due to forced migration: a result oflimited employment opportunities in the rural agriculture sector, and repeated occurrences of natural disasters. As urban poverty continues to increase urban life and development becomes drastically hindered. .

The extension of microfinance outreach is more feasible in urban areas than in rural areas because of lower transaction costs. . Women’s participation in UMC is also higher in comparison to RMC since they have better access to the labor market and material resources, more freedom of movement, and greater influence in household decision-making. Moreover, the urban poor are generally considered as safe borrowers since urban economic environment provides dynamic and diversified economic opportunities.

Target members of UMC must be residents of urban or semi-urban localities for at least three years with no assets, and a monthly income of BDT 4000-5000. People who have businesses, even on a temporary basis, with a good record in handling previous loans are also covered under UMC.

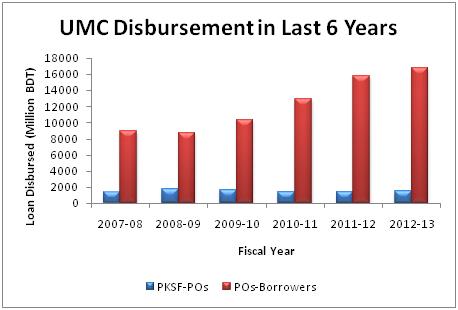

In FY 2012-13, PKSF’s loan disbursement to its POs under UMC is BDT 1522.30 million with an outstanding loan of BDT 2889.88 million, while POs disbursed BDT 16832.66 million to their borrowers through UMC with an outstanding loan of BDT 8167.15 million. As of June 30, 2013, the average loan size under UMC to the borrowers was BDT 19,647, which is 20.35% higher than RMC. Since its inception, 78% of the members of UMC have been extended loan facilities. Under this programme, loan disbursement to POs has been increased by 6.12% in FY 2012-13 from that of the previous FY. POs disbursement to their borrowers grew by 6.58% indicating the increasing capacity of the POs to circulate loans among the poor under UMC (Figure 9.0 & 10.0).