PKSF’S

FINANCIAL Activities

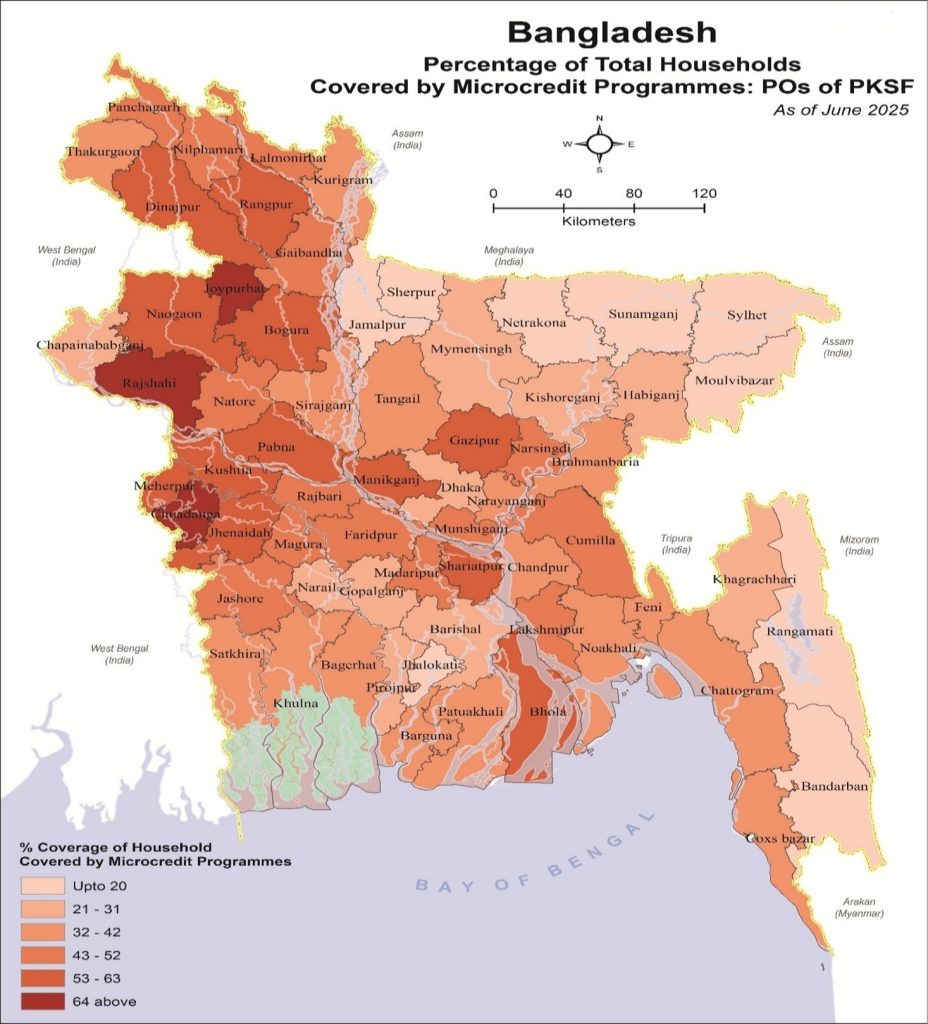

Our National Footprint: Reaching Every Corner

Since its inception in 1990, Palli Karma-Sahayak Foundation (PKSF) has expanded its development footprint across all 64 districts of Bangladesh, reaching over 20.70 million members through a dynamic network of Partner Organizations (POs) and their extensive branch operations. PKSF ensures that even the most remote and climate vulnerable areas such as coastal belts, haor regions, and hilly tracts are served with inclusive financial and development services.

National Outreach Summary

Sl. No. | Indicator | Coverage/Value | Remarks | ||

1 | Families Served | 20 million+ | Inclusive outreach covering diverse socio-economic groups across rural and urban areas | ||

2 | Area Coverage | 64 Districts, 487 Upazilas & 12 City Corporations | Nationwide operational network ensuring equitable regional access | ||

3 | Coverage as % of Estimated Population (2025) | 9.16% | Represents nearly one-tenth of Bangladesh’s total population directly benefiting from PKSF-supported interventions | ||

4 | Coverage as % of Total Households (2025) | 38.48% | Reflects strong household-level penetration contributing to poverty alleviation and livelihood improvement | ||

5 | No. of Partner Organizations (POs) | 200+ | Over 200 active Partner Organizations implementing PKSF programs across all regions | ||

6 | No. of Branch Offices of POs | 19,000+ | Extensive grassroots presence ensuring last-mile delivery of financial and non-financial services | ||

7 | Member’s Savings | BDT 352.31 billion | Represents total voluntary and compulsory savings accumulated by members through PKSF’s partner organizations (POs). | ||

8 | Loan Outstanding: PKSF-PO Level | BDT 141.05 billion | Indicates the cumulative amount of loans disbursed by PKSF to its partner organizations and remaining outstanding as of reporting period. | ||

9 | Loan Outstanding: PO-Member Level | BDT 858.29 billion |

| ||

10 | Average Loan Size | BDT 82,136.00 | Reflects the average credit support extended per borrower. | ||

11 | Climate/Remote Areas | Coastal, Haor, Hills | Targeted resilience and adaptive livelihood programs for climate-vulnerable and geographically isolated communities |

Women at the Core of Change

Women remain central to PKSF’s development and lending activities. Through targeted financing and institutional support, PKSF has empowered millions of women to become active participants in economic and social transformation.

Sl. No. | Indicator | Achievement | Remarks | ||

1 | % of Women Borrowers | 93.24% | Women-led credit dominance | ||

2 | Female Borrowers of Microenterprise Loan (AGROSOR) | 3.10 million+ | Promoting female entrepreneurship | ||

3 | Women in PO Leadership | 15%+ |

| ||

4 | Female Staff in POs | 20%± | Gender-inclusive workforce | ||

5 | Maternal Health Care | 1.47 million + | Empowering mothers through healthcare |

These achievements underscore PKSF’s holistic approach to gender equity ensuring that women are not only recipients of financial services but also active agents of sustainable change.

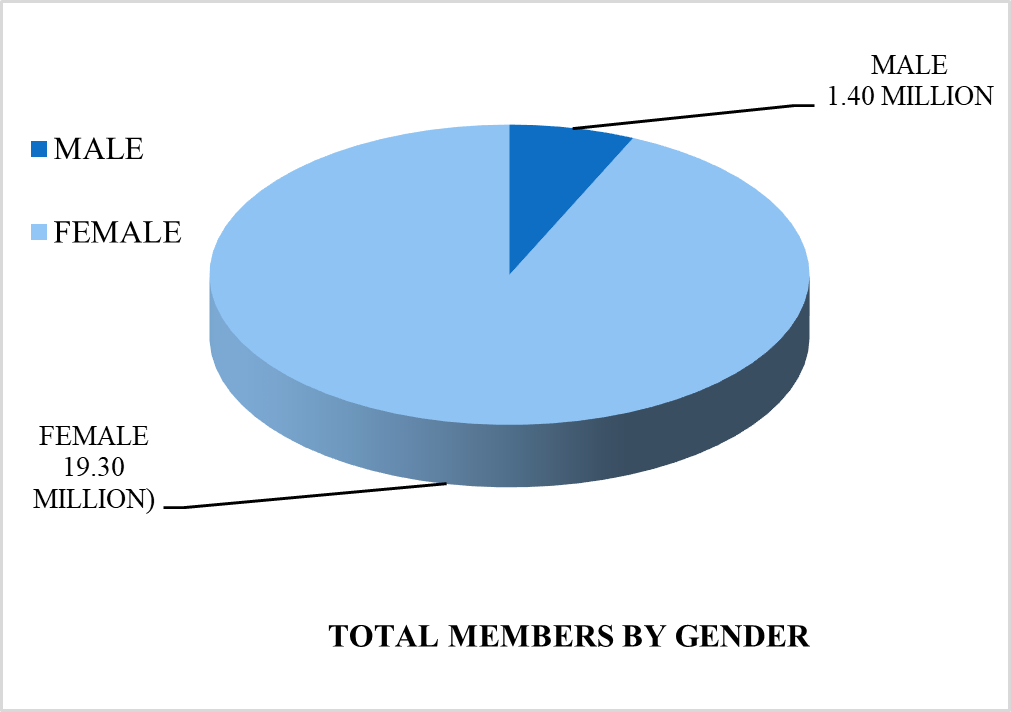

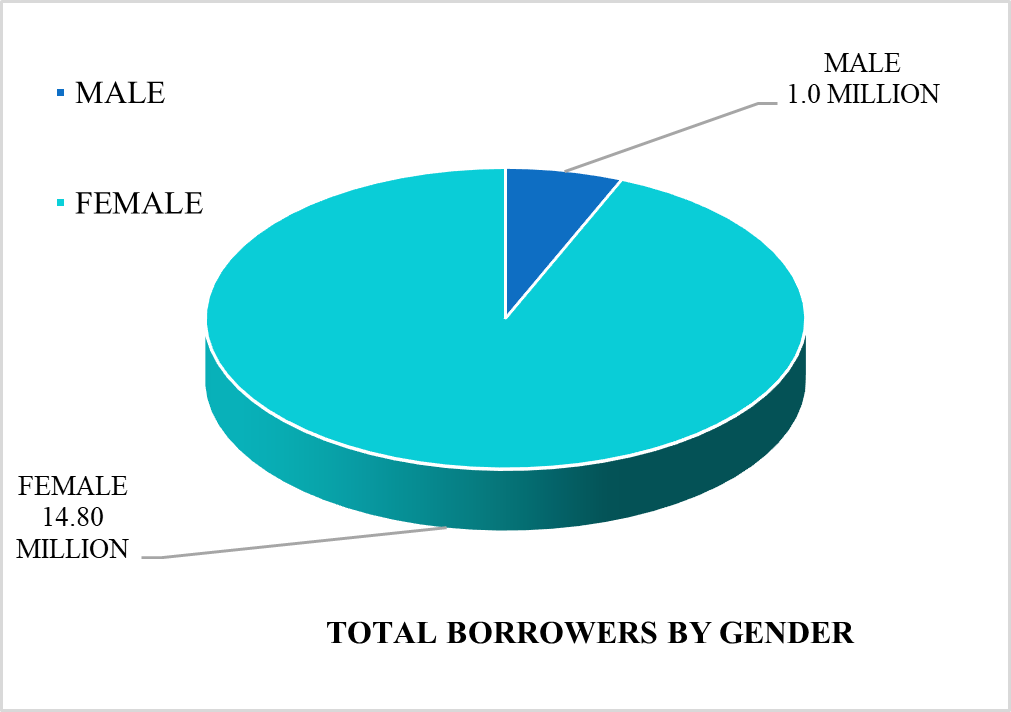

Members and Borrowers

Data reflects a steady and significant growth in the number of members and borrowers associated with Partner Organizations (POs) of PKSF over the past three decades. Beginning with a negligible base in FY 1990–91, both members and borrower activities have expanded exponentially, indicating PKSF’s widening institutional reach and the growing inclusion of rural populations in microfinance activities. By FY 1999-2000, members reached 2.92 million and borrowers 2.31 million, demonstrating early program expansion. This growth accelerated rapidly during the subsequent years, with 10.96 million members and 8.39 million borrowers by FY 2009-10. The trend continued upward, reaching 20.70 million members and 15.80 million borrowers by FY 2024-25 representing nearly a 20-fold increase in members and a 17-fold increase in borrowers compared to FY 1994-95. The narrowing gap between members and borrowers in recent years also highlights improved access to credit services and enhanced operational efficiency among POs under PKSF’s supervision.

(In Million)

FY | No. of Members | Growth (%) | No. of Borrowers | Growth (%) | Trend Observation |

1990–91 | 0.00 | – | 0.00 | – | Baseline program inception stage |

1991-92 | 0.02 | – | 0.02 | – |

|

1994–95 | 0.29 | 1350.00% | 0.29 | 1350.00% | Initial outreach to member base |

1999–2000 | 2.92 | 906.90% | 2.31 | 696.55% | Rapid expansion of microfinance operations |

2004–05 | 7.75 | 165.41% | 5.52 | 138.96% | Strong growth in borrower engagement |

2009–10 | 10.96 | 41.42% | 8.39 | 51.99% | Consolidation and program maturity |

2014–15 | 11.12 | 1.46% | 8.55 | 1.91% | Steady growth with portfolio diversification |

2019–20 | 14.42 | 29.68% | 10.95 | 28.07% | Rising participation and enhanced inclusion |

2024–25 | 20.70 | 43.55% | 15.80 | 44.29% | Record expansion wider financial outreach |

As of June 2025, the total number of members of all Partner Organizations (POs) under PKSF stands at 20.70 million. Among them, 19.30 million are women, representing 93.24% of the total members During the same period, the total number of borrowers is 15.80 million, of which 14.80 million are women, accounting for 93.67% of the total borrowers.

SAVINGS GROWTH OVER 8 YEARS

Members’ savings shows a consistent and significant upward trend from FY 2017–18 to FY 2024–25. Members’ total savings increased from BDT 92.04 billion in FY 2017-18 to BDT 352.31 billion in FY 2024-25, marking a remarkable growth of nearly 283 percent over the period. This steady rise reflects the increasing trust and participation of members in savings programs of PKSF’s POs. The growth was particularly notable during FY 2021-22 to FY 2022-23, when savings rose sharply by over 25 percent each year, indicating enhanced financial awareness and inclusion among members. The upward trend continued through FY 2024–25, underscoring the strong institutional capacity and confidence of the members in the microfinance program.

District-wise Loan Program Coverage:

With PKSF’s financial assistance, Partner Organizations (POs) are implementing loan programs across all 64 districts, 487 upazilas, and 12 city corporations of the country. An analysis of district-wise population and loan program data reveals that approximately 74% of total households in Chuadanga district are covered under the loan program the highest coverage among all districts. In contrast, only about 9% of total households in Sunamganj district are under the loan program the lowest coverage. Notably, in three districts, more than 70% of total households are covered under the loan program, while in 18 districts, less than 30% of total households are under coverage.

From Access to Empowerment: The Journey of Inclusive Finance

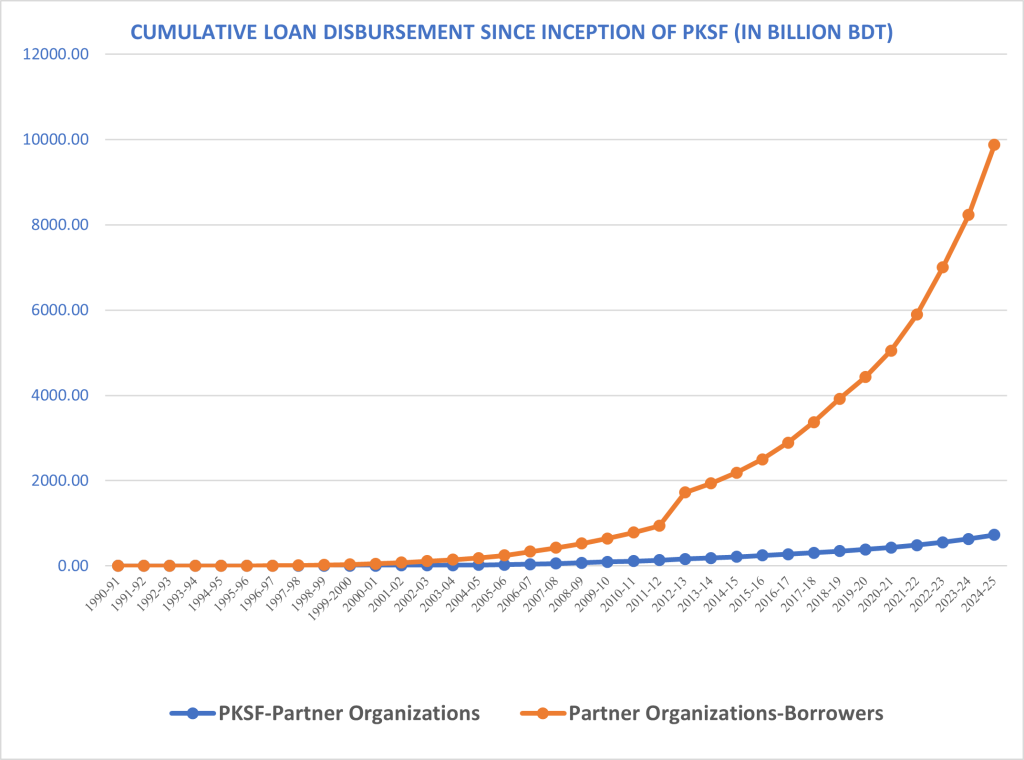

Cumulative Loan Disbursement

PKSF has evolved from a microcredit apex organization to a comprehensive livelihood-promoting institution. Its lending activities are structured to promote financial inclusion, entrepreneurship, and resilience across multiple sectors. Collectively, PKSF’s Partner Organizations (POs) have disbursed over BDT 9.15 trillion among grassroots members since inception, covering rural, urban, and specialized programs. This continuous growth highlights PKSF’s focus on evidence-based lending and development-oriented financial inclusion.

(BDT in Billion)

FY Range | PKSF-PO Level | Growth (%) | PO-Member Level | Growth (%) | Remarks |

1990-1995 | 0.63 | – | 1.40 | – | Early microfinance expansion |

1996-2000 | 8.25 | 1209.52% | 28.73 | 476.85% | Rapid growth with new POs |

2001-2005 | 22.03 | 167.03% | 165.73 | 232.81% | Introduction of SME lending |

2006-2010 | 93.99 | 326.65% | 551.57 | 257.15% | Enterprise & sectoral diversification |

2011-2015 | 216.26 | 130.09% | 1969.92 | 105.30% | Integration of agriculture & value chains |

2016-2020 | 385.83 | 78.41% | 4044.28 | 126.25% | Digital MIS integration |

2021-2025 | 727.34 | 88.51% | 9150.22 | 476.85% | Inclusive & technology-driven finance |

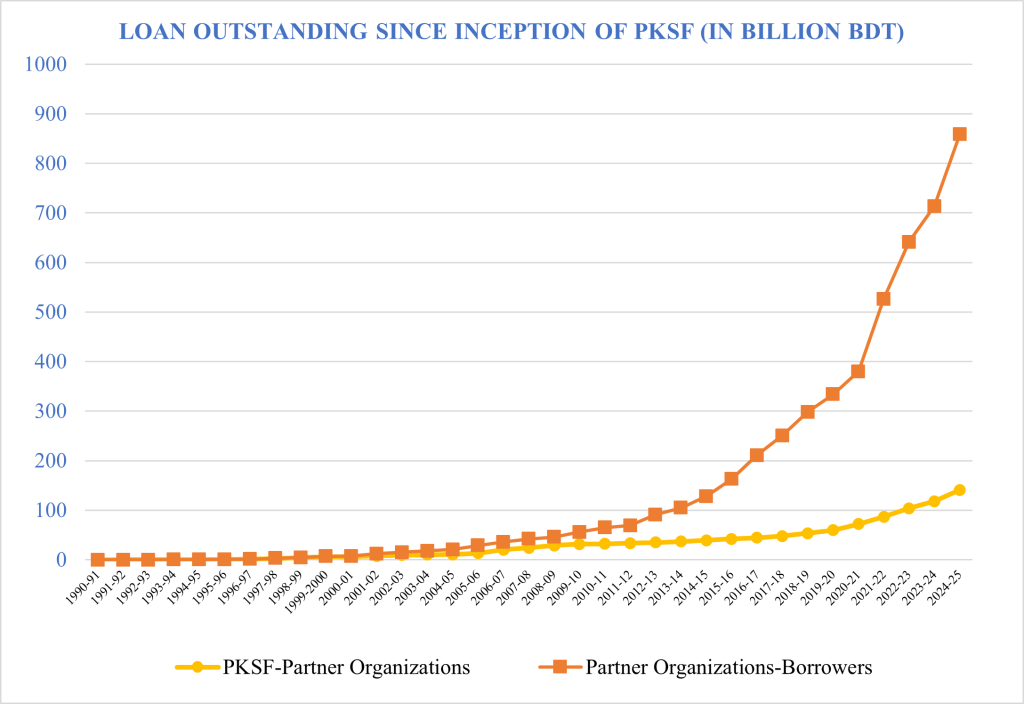

Loan Outstanding

The data shows a consistent and remarkable growth in loan outstanding amounts at both the PKSF-PO level and the PO–Member level over the past three decades. Starting from a baseline of 0.02 billion in FY 1990-91, both levels have shown exponential increases, reflecting PKSF’s expanding outreach and the increasing credit utilization capacity of Partner Organizations (POs) and also their members. By FY 1999-2000, the outstanding amount at the PKSF–PO level reached BDT 6.11 billion, while the PO–Member level stood at BDT 6.82 billion. This trend accelerated sharply thereafter, with the PO-Member level showing a faster growth rate by FY 2019-20, the figure was BDT 333.87 billion, compared to BDT 59.87 billion at the PKSF–PO level. FY 2024–25 indicates a significant escalation to BDT 141.05 billion and BDT 858.29 billion respectively, suggesting over six-fold growth within five years. This rapid increase underscores PKSF’s deepening financial engagement and the growing demand for microfinance at the member level.

(BDT in Billion)

FY | PKSF-PO Level | PO-Member Level | Remarks |

1990–91 | 0.02 | 0.02 | Baseline year operations initiated |

1994–95 | 0.46 | 0.48 | Early-stage disbursement activities |

1999–2000 | 6.11 | 6.82 | Expansion of PKSF’s credit programs |

2004–05 | 10.67 | 20.77 | Rapid increase in member-level outreach |

2009–10 | 31.63 | 55.99 | Consolidation and growth of lending portfolio |

2014–15 | 39.48 | 128.23 | Diversification of financial products |

2019–20 | 59.87 | 333.87 | Sharp rise in field-level credit flow |

2024–25 | 141.05 | 858.29 | Record expansion strong institutional capacity |

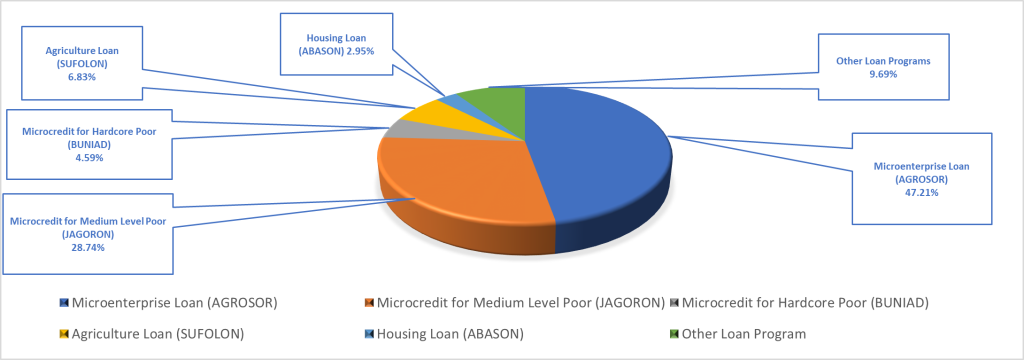

Sector-wise Loan Outstanding of PKSF at the Partner Organization (POs) Level

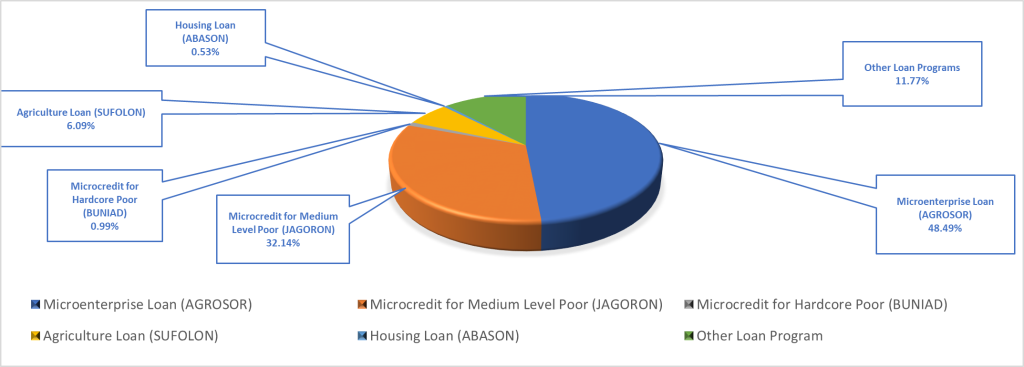

As of June 2025, the total loan outstanding of PKSF at the POs level stands at BDT 141.05 billion. Among this, BDT 66.59 billion belongs to the Microenterprise Loan (AGROSOR), BDT 40.53 billion to the Microcredit for Medium Level Poor (JAGORON), BDT 6.47 billion to the Microcredit for Hardcore Poor (BUNIAD), BDT 9.62 billion to the Agriculture Loan (SUFOLON), BDT 4.15 billion to the Housing Loan (ABASON) and BDT 13.67 crore to Other Loan Programs.

The percentage distribution of PKSF’s sector-wise loan outstanding at the POs level is as follows: Microenterprise Loan (AGROSOR) 47.21%, Microcredit for Medium Level Poor (JAGORON) 28.74%, Microcredit for Hardcore Poor (BUNIAD) 4.59%, Agriculture Loan (SUFOLON) 6.83%, Housing Loan (ABASON) 2.95%, and Other Loan Programs 9.69%.

% of PKSF’s loan outstanding by sector at the POs Level as of June 2025

Sector-wise Loan Outstanding of Partner Organizations (POs) at the Member Level

As of June 2025, the total loan outstanding of POs at the member level stands at BDT 858.29 billion. Of this amount, BDT 416.14 billion belongs to the Microenterprise Loan (AGROSOR), BDT 275.83 billion to the Microcredit for Medium Level Poor (JAGORON), BDT 8.49 billion to the Microcredit for Hardcore Poor (BUNIAD), BDT 52.25 billion to the Agriculture Loan (SUFOLON), BDT 4.52 billion to the Housing Loan (ABASON) and BDT 101.03 billion to Other Loan Programs.

The percentage distribution of sector-wise loan outstanding of POs at the member level is as follows: Microenterprise Loan (AGROSOR) 48.49%, Microcredit for Medium Level Poor (JAGORON) 32.14%, Microcredit for Hardcore Poor (BUNIAD) 0.99%, Agriculture Loan (SUFOLON) 6.09%, Housing Loan (ABASON) 0.53% and Other Loan Programs 11.77%.

% of PO’s loan outstanding by sector at the Members Level as of June 2025

TOTAL MEMBERS

20.70 Million

The organized members at the grassroots are the life force of PKSF’s operations. As of June 2025, the aggregated number of members organized through all the Partner Organizations of PKSF stands at 20.07 million, 93.24% of whom are women. At the same time, the number of borrowers is 15.80 million. Of them, 14.80 million are women (93.67%).

MORE THAN 200

PARTNER ORGANIZATIONS

As on 30 June 2025, PKSF has more than two hundred POs. These organizations, picked through a stringent process of assessment, are considered an integral part of PKSF’s operational structure. They are entrusted with implementing PKSF’s programs and projects at the grassroots.

IN THE FINANCIAL

YEAR 2024-2025

WOMEN’S PARTICIPATION

0.70 MILLION NEW MEMBERS ENROLLED

OF THE TOTAL BORROWERS,

93.67% ARE FEMALE

SAVINGS GROWTH OVER 8 YEARS

(IN BILLION BDT)

TOTAL SAVINGS OF THE MEMBERS

BDT 352.31 Billion

SAVINGS Increased IN FY 2024-25

BDT 69.93 Billion

PKSF – PARTNER ORGANIZATIONS (POs)

LOAN DISBURSEMENT AND OUTSTANDING

Loan disbursement of PKSF recorded a steady growth in FY 2023-24 and 2024-25. The amount of loan disbursement from PKSF to POs was BDT 75.53 Billion in FY 2023-24. In FY 2024-25, loan disbursement from PKSF to POs amounted to BDT 93.58 Billion, 23.89% higher than the previous year.

LOAN OUTSTANDING FROM PKSF TO POs

BDT 141.05 Billion

As on 30 June 2024, the amount of loan outstanding of PKSF with its Partner Organizations (POs) stands at BDT 118.21 Billion.

PARTNER ORGANIZATIONS (POs)-BORROWERS

IN FY 2024-25, AMOUNT OF LOAN

DISBURSEMENT FROM POs TO BORROWERS

BDT 1,554.00 Billion

In FY 2023-24, loan disbursement from POs to borrowers amounted to BDT 1,151.23 Billion.

LOAN DISBURSEMENT AND OUTSTANDING

In FY 2024-25, the amount of loan disbursement from the POs to their borrowers was BDT 1,554.00 Billion, which is 34.99% higher than the previous year. As on 30 June 2025, the amount of loan outstanding of the POs with borrowers is BDT 858.29 Billion.