With the objective of improving the living conditions of the low-income households living in towns, PKSF and the National Housing Authority (NHA) are jointly implementing the Low Income Community Housing Support (LICHS) Project. PKSF is implementing the project’s Component-3 titled ‘Shelter Lending & Support’ through its Partner Organizations (POs). The project tests suitable models for housing microfinance that can be leveraged to meet the needs of the low income communities in urban areas.

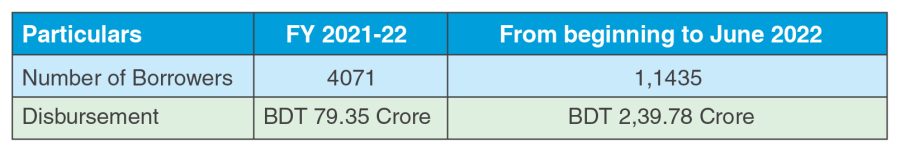

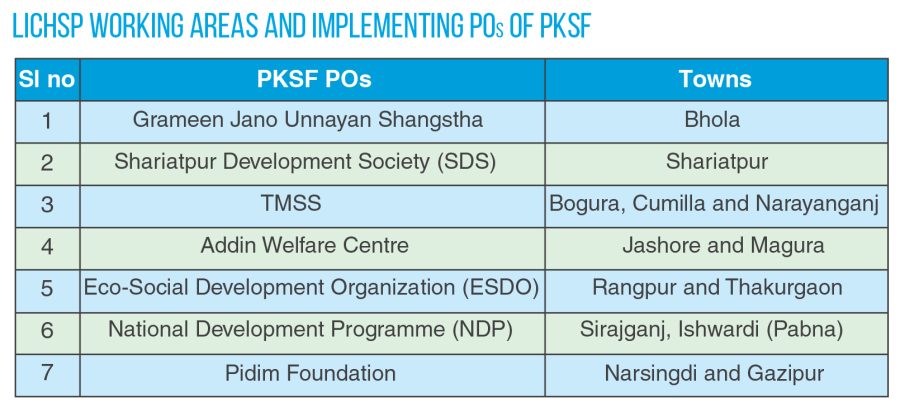

The project, co-funded by The World Bank and the Government of Bangladesh, is being implemented in 13 towns through 7 POs of PKSF. As of June 2022, a total of 11,435 borrowers received loans amounting to BDT 2397.8 crore for construction of new houses, renovating/repairing and extending existing houses. A large number of households in the working area are engaged in home-based enterprises and therefore, houses were seen as an asset, investing in which would yield return. A number of borrowers started a small shop at home and have contributed to their household income. Better health, peace of mind, social security and dignity of the members have increased and a better learning environment for children has been ensured. To observe field progress made over the last five years, a World Bank delegation led by its Country Director for Bangladesh and Bhutan – Dr Mercy Miyang Tembon – visited the LICHS project’s activities in Cumilla on 20 May 2022. and WB’s Practice Manager Robin Mearns, among others, accompanied her. The project’s component implemented by PKSF has been rated ‘Highly Satisfactory’ by the World Bank.

Implementation Arrangements and Housing Loan Features

The working areas of this project include both NHA and non-NHA towns. In the NHA towns, the NHA is responsible for selecting settlements for improving living condition of the poor by mobilising communities and constructing tertiary infrastructures. PKSF provides overall technical and monitoring support to its designated POs to implement the lending component at the field level. In the non-NHA areas, the POs are responsible for borrower assessment, as well as ensuring compliance to environmental safeguards, construction standards, and any other requirements of the credit line. In all cases, at any stage of the project, the POs possess full discretion to identify and assess borrowers and extend housing loans.

Working Areas

Disbursement

The Government of Bangladesh (GoB) requested the International Development Association (IDA) of the World Bank (WB) to make available a loan to the GoB amounting to Special Drawing Rights (SDR) 36,300,000 for the LICHSP. To facilitate implementation of the Part 3 of the project — Shelter Lending and Support, the GoB has allocated to PKSF US$ 18 million to realise two components: (i) on-grant component in an amount not to exceed the equivalent of US$ 2 million, and (ii) on-lend component in an amount of US$ 16 million.

A total of BDT 353 million in loans has been disbursed to seven POs by PKSF. The Project Management Unit (PMU) is closely monitoring the activities at the field level to ensure quality and progress of those. Five POs have disbursed a total of BDT 335.13 million to 1,162 borrowers for constructing new houses, repairing old houses and extending existing houses, as of 30 June 2019. The recovery rate for this loan service is 100 per cent at all levels.

Reflections from the World Bank

According to the World Bank Mission, PKSF activities under this project has been “Satisfactory” since its inception.

Basic Features of LICHSP

This project explores how to best design and provide affordable housing loans to low-income people for repairing and extending existing houses and constructing new ones. This housing loan service is the first of its kind in PKSF operations. The lessons so far learned from this project are:

- There is a demand for housing loans at the local level.

- PKSF can use its comparative advantages of having a strong and wide network of more than 200 competent POs — working in every corner of the country and serving more than 13 million households — in implementing the housing loan program, in particular for low-income groups. The selected POs under this project have gained extensive knowledge about this new financial product. And this model can easily be replicated in other towns and through other POs.

- PKSF and its POs maintain strong financial disciplines. As a result, Non-Performing Loan is at 0% as the recovery rate is 100% under the project. PKSF has a constant and cost-effective monitoring system. Its main strength lies in its strong rapport building capacity with the field-level participants.

- Housing loan can be an effective means for portfolio diversification for both PKSF and its POs.

- POs have developed a sustainable market-based housing loan product by —

- adopting flexibility in lending arrangements (e.g., seeking alternative forms of security such as savings, co-signers, personal guarantors, peer pressure, group liability etc),

- ensuring that the loan is affordable for the clients (e.g., incremental, cluster-based with joint ownership),

- facilitating construction/improvement of houses,

- offering technical assistance on building process,

- acting as a channel for quality housing and the linked products, and

- organizing groups to construct houses on shared land.

- Attempts have been made to disburse loans through the commercial banks.

- A systematic affordability tool has been developed.

- Willingness for taking housing loans exists mostly in the households that have a regular stream of income and view their houses as an asset that eventually adds to the household income, increases social dignity and reduces their human poverty.

- A large number of households in the working areas are engaged in home-based enterprises and they therefore consider their houses as an asset, investing in which yields return. Many have started small shops at home, contributing to their household income.M

- Many borrowers already recognized that they are getting benefits in terms of health, mental peace, physical security and children’s education after using this loan.

Areas of Concern

Despite the vast opportunities for the housing loan product, there are some challenges, as mentioned below, that need attention.

- Land entitlement often is an issue.

- Without subsidy, it seems to be hard for the extremely poor households to afford a housing loan.

- The housing loan amounts generally offered by the POs are not always sufficient. There should be a scope for increasing the loan amount in the cases of more capable households within the monthly income brackets stated in the project documents.

- Many borrowers mention that the loan tenure as an important determinant of their willingness to take a housing loan. Some have shown preference in availing the loan with a duration of 6 years, instead of the existing 5-year tenure.

Related Thematic Area: