Microenterprise Development Project (MDP)

PKSF completed the implementation of ‘Microenterprise Development Project (MDP)’ with USD 50 million loan and USD 0.50 million technical assistance from Asian Development Bank (ADB) to support various microenterprises (MEs) with the objective of inclusive economic development and reduction of rural poverty. Launched on 01 January 2019, the MDP was completed on 31 March 2021 through 77 Partner Organizations (POs). On its closure, financial assistance of BDT 996 crore has been provided to 68,562 micro entrepreneurs of whom 83% are female. The microenterprises, with support from the project, created employment for 1.81 lac people of whom 40% are female. Environmental and social safeguard measures had been fully ensured for each of the microenterprises.

To upscale different business cluster-based microenterprises, MDP integrated financial services with the non-financial services of other similar projects of PKSF. Various technologies were incorporated to increase efficiency and productivity. Micro entrepreneurs have been involved with Mobile Financial Services (MFS) to make business transactions and financing activities easier. 27,998 micro entrepreneurs were enrolled in MFS and 11,146 of them were trained on MFS. MFS enables micro entrepreneurs to pay loan installments from home and abroad. MDP provided assistance to the micro entrepreneurs in three different business clusters for product quality improvement, packaging, branding etc. Furthermore, the products of the business clusters were linked with the e-commerce platforms to sell them in the wider market. In this context, entrepreneurs have been trained on e-commerce operation.

Microenterprise Development Project-Additional Financing (MDP-AF)

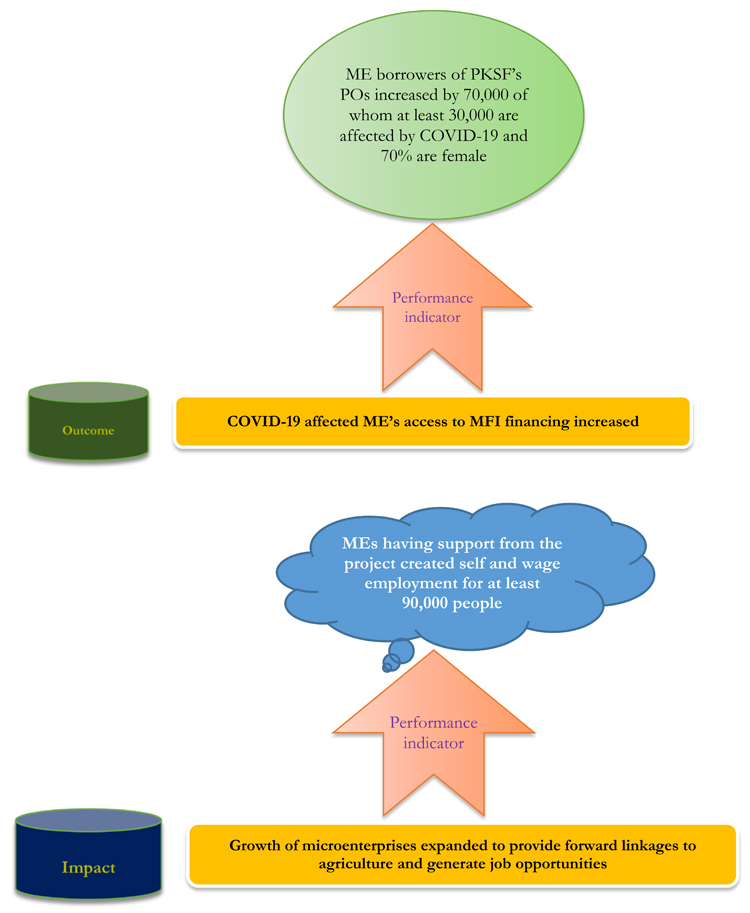

In continuance of MDP, PKSF is now implementing the ‘Microenterprise Development Project-Additional Financing (MDP-AF)’ across the country through 97 selected partners for 30,000 new micro entrepreneurs (of which 70% will be women) with the fund of another USD 50 million (BDT 424 crore) loan and USD 0.50 million for technical assistance from ADB to mitigate the negative impacts of the COVID-19 pandemic by injecting liquidity in the rural economy. This 2-year project will be completed in June 2023. Again, all environmental and social safeguard measures will be ensured. Mobile Financial Services (MFS) and all other supports in quality improvement, packaging, branding and selling of the products in the wider market through e-commerce platforms including capacity development will be in place. The microenterprises are expected to create sustainable self/wage employment for 90,000 people.

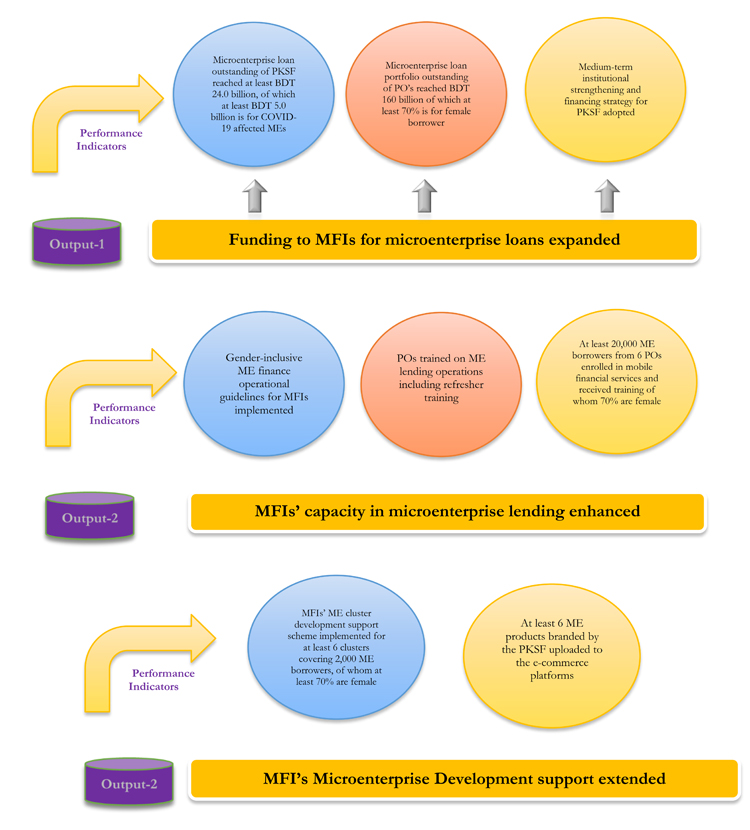

Outputs

Impacts

Updated Progress

PKSF is implementing the Microenterprise Development Project – Additional Financing (MDP-AF) to provide financial support of BDT 424 crore to 30,000 microenterprises negatively affected by the Covid-19 pandemic to revive their economic activities. Till June 2022, BDT 714.95 crore was disbursed in loans among 48,246 micro-entrepreneurs through 97 Partner Organizations (POs). About 80 percent of the borrowers are women.

Sustainable microenterprises in the context of environmental and social safeguard issues are being financed through the project. So far 1,18,550 people have been employed in the microenterprises with MDP’s financial assistance.Under the ‘Technical Assistance’ component, various activities like mainstreaming the Mobile Financial Services (MFS) in microenterprises’ financing activities, assistance in product quality improvement, packaging, branding of the products of three potential microenterprise business clusters, and capacity building for PO staff members in microenterprise development are being implemented.

PCR Summary

Related Thematic Area: