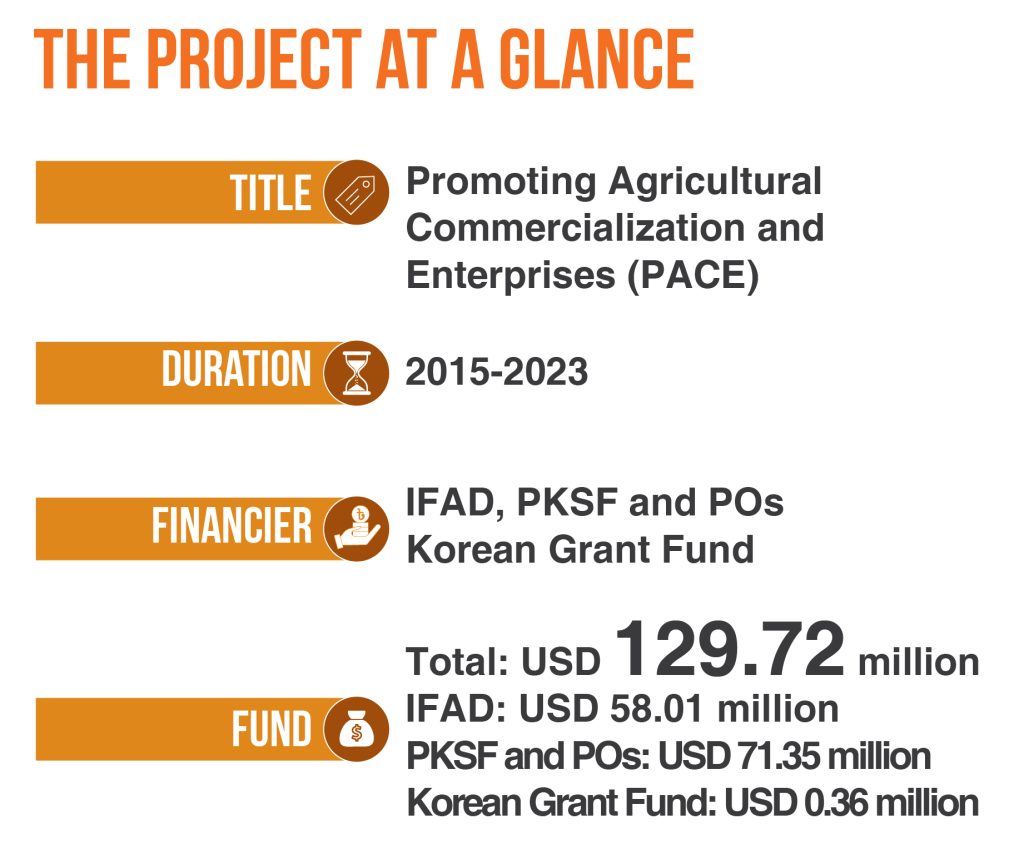

PKSF launched Promoting Agricultural Commercialization and Enterprises (PACE) project in January 2015. The project is jointly financed by PKSF and International Fund for Agricultural Development (IFAD). The Financing Agreement of the project was signed between the Government of the People’s Republic of Bangladesh and IFAD on 11 December 2014. Subsequently, PKSF signed Subsidiary Loan and Grant Agreement (SLGA) with the Ministry of Finance, Government of Bangladesh on 18 January 2015 to implement the project.

Prior to the PACE Project, PKSF implemented three other IFAD funded projects, these are: i) Microfinance and Technical Supports (MFTS) Project, ii) Microfinance for Marginal and Small Farmers (MFMSF) Project and iii) Finance for Enterprise Development and Employment Creation (FEDEC) Project. All three projects were implemented very successfully and contributed significantly in poverty reduction and employment generation. The PACE Project is designed on the basis of the experience and learning of the above-mentioned three projects to expedite further the process of poverty reduction by promoting microenterprises in the country. This project was scheduled to be completed by 31 December 2020.

Additional Financing (AF) phase

Like many other countries, Bangladesh was severely affected by COVID-19 pandemic in 2020. Repeated declaration of general holidays (shut down), various restrictions to ensure social distance for prevention of COVID-19 disrupted the whole economy of the country. Microenterprise was one of the worst affected economic sectors of the country. To restore economic activities and recover the losses of microenterprise sector the government of Bangladesh and IFAD extended the project for 3years until 31 December 2023. The amended Financial Agreement was signed on 16 September 2021 and the Subsidiary Loan and Grant Agreements signed on 15 December 2021.

Goal and Objectives

The project goal is to enhance livelihoods (higher income from self-employment, business profit and wage employment, and food security) of the moderate and extreme poor (men and women) in a sustainable manner.

The development objectives are to increase sales and incomes from existing and new microenterprises and to create new wage employment opportunities for extreme and moderate poor people.

Project Participants

The target population of PACE project will include microentrepreneurs, i.e. who are borrowers of ME loan program, moderately poor and extremely poor persons. In terms of professional identities, the project will target marginal and small farmers involved in field crops, horticulture, fisheries, livestock production, non-farm micro entrepreneurs, and professionals in service sectors. The project will extend financial services to additional 150,000 micro-entrepreneurs. Under the Value Chain Development of the project, 420,000 project participants will receive non-financial services while 50,000 entrepreneurs will be benefited under the component of Technology and product adaptation.

Components and Activities

The PACE Project has three complementary components.

a) Financial services for microenterprise: The project is strengthening the Microenterprise Program of PKSF and is providing sustainable financial services for the expansion of microenterprises (farm, off-farm, trading and service sectors). The outputs of this component are: a) expansion of microenterprise loans for various sectors (e.g. agriculture, processing, trade and services); b) piloting of new loan products; and c) capacity building of PKSF and POs in designing and developing of new financial products, monitoring, evaluation and impact assessment of ME program and application of information technology in management of POs.

b) Value Chain Development: Under the Value Chain Development component of the project, PKSF is making value chain interventions in various farm and non-farm sector to help upscaling of business, adoption of appropriate technologies, enhance productivity and ensure access to markets in a sustainable manner.

c) Technology and product adaptation: The project has introduced proven technologies and products (agricultural and off-farm) from Bangladeshi and international sources to the micro entrepreneurs.

Progress of the Project Activities

To expedite poverty reduction through promoting potential microenterprise (ME) sector of the country, PKSF is implementing the Promoting Agricultural Commercialization and Enterprises (PACE) Project, co-financed by the International Fund for Agricultural Development (IFAD). Although the project was slated for completion in December 2020, it is now being implemented in its extended period (2021-23) to restore economic activities in the ME sector adversely affected by the COVID-19 pandemic.

With an additional financing of $36.86 million, the total cost of the project is $129.71 million in which IFAD’s financing is $58.07 million. In addition to providing financial services to MEs, PACE extends value chain development and appropriate technology transfer support to promote different potential farm and non-farm economic activities. In the extended period, the project is working for developing a safe and hygienic rural market, promote decent work environment in microenterprises and expand e-commerce services in the microenterprise sector.

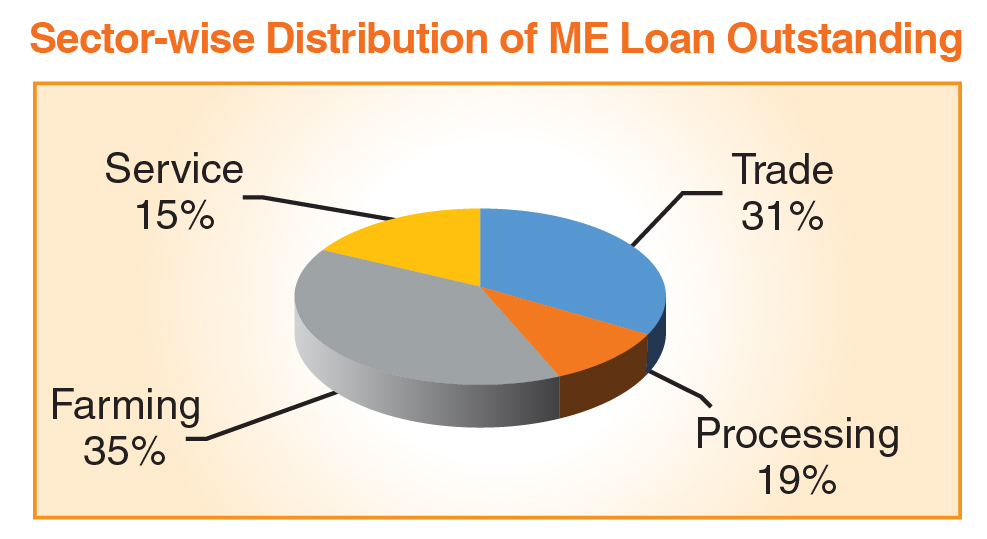

a) Financial services for microenterprise: After achieving the disbursement target in PACE’s original phase, the project now provides financial services to expand microenterprises in its extended period. The net disbursement of the project during this time was BDT 91.36 crore which is 99% of the target. Microentrepreneurs receive loans for 156 economic activities under four major sectors namely farming, processing, trade and service sectors through the mainstream ME program of PKSF. The shares of loan disbursement in farming, processing, trade and service sectors are 35%, 19%, 31% and 15% respectively. PKSF emphasizes on increasing credit disbursement in the processing sector as it generates more employment.

PKSF has taken an initiative to diversify financial products according to the needs of the different types of entrepreneurs. The project successfully piloted ‘start-up capital loan’ for young people with technical skills and entrepreneurial ideas. At the same time, it has successfully piloted another financial product named ‘lease financing’ to assist entrepreneurs in obtaining capital assets. During the extended period, the project is expanding these two financial products at the field level through 21 Partner Organizations of PKSF.

b) Value chain development: During the extended period of PACE, 42 new value chain sub-projects are being implemented for the development of potential farm and non-farm sub-sectors in the country. The sub-sectors include medicinal plant processing, dairy product, ecotourism, imitation gold jewelry, fruits and agriculture product processing, tissue culture lab, beekeeping development and honey marketing, crab hatchery, year-round onion cultivation, native chicken rearing, cow rearing, bio fertilizer production from urban waste, ecological farming, high value spice cultivation, safe fish and fish product production, conservation and development of natural fish breeding ground of the Halda river, duck rearing, cultivation of high value crops in saline land, expansion and marketing of crab farming technology, safe vegetable production, aromatic paddy production, brass industry development. Necessary technological and marketing support is being ensured for helping the sub-sectors overcome economic losses due to the pandemic and expand more sustainably.

Value chain interventions have been made in 16 farm and 16 non-farm sub-sectors according to the project target. The sub-projects are being implemented in 88 upazilas of 27 districts, offering technical, technological and marketing support to 221,384 entrepreneurs and stakeholders. PACE successfully completed 33 value chain sub-projects undertaken in its original phase.

c) Technology and Product Adaptation: The PACE project attempted to solve technological problems in different potential economic sub-sectors under the component of technology and product adaptation. The project provided technological support to the microentrepreneurs engaged in various economic activities in different regions of the country. The project undertook 25 technology and product adaptation sub-projects to transfer 11 proven technologies and 15 products in different sub-sectors. So far, 30,868 project participants received technological support under PACE Project.

Training and workshop: The PACE project organizes training for institutional capacity building of PKSF and POs. It organized four workshops on ‘Start-up Capital Loan’ for new entrepreneurs and ‘Lease Financing’ for existing entrepreneurs to acquire capital assets for their business expansion. The officials concerned of selected POs learned about the implementation strategy of these two financial products through the workshops.

Project Cost: The total project cost is USD 129.72 (Original phase USD 92.85 and Additional financing phase USD 36.86 million). Component wise cost allocation is given below.

Component | PACE-original phase (USD million) | PACE-AF phase (USD million) | Total |

1- Financial services for microenterprises | 70.60 | 30.30 | 100.9 |

2- Value chain development | 15.00 | 5.36 | 20.36 |

3-Technology & Product Adaptation | 0.87 | 0 | 0.87 |

4– Project management | 0. 64 | 1.2 | 69.37 |

Total | 92.85 | 36.86 | 129.72 |

Project Financing: The project is jointly financed by IFAD, PKSF, Korean grant and POs of PKSF. The breakdown of project financing is given below:

Component | PACE-original phase (USD million) | PACE-AF phase (USD million) | Total |

IFAD | 40.00 | 18.01 | 58.01 |

Korean Grant | 0.36 | 0 | 0.36 |

PKSF | 22.45 | 3.86 | 26.31 |

POs | 30.04 | 15.0 | 45.04 |

Total | 92.85 | 36.86 | 129.72 |

PACE-PMU

Md. Habibur Rahman | ||

Dr. S. M. Faruk-Ul-Alam | Md. Kamrul Islam Value Chain Specialist (Agri-business) M.S (Plant Pathology) Bangladesh Agricultural University | Md. Mizanur Rahman |

Sanchita Islam | Md. Masum Sarker | Md. Nur Alam

|

| Suman Kumar Saha Value Chain Project Manager M.S (Crop Botany) Bangladesh Agricultural University | Farhana Haque Ovi | Md. Naim Ul Islam |

Related Thematic Area: