Project Overview

Special Features

Services

Project Activities

News & Events

RAISE Publication

Photo Gallery

Project Management Unit

Bangladesh is one of the fastest growing economies and is expected to become the 24th largest economy in the world by 2030 (NHDR 2022, ERD). While it was primarily an agricultural economy in 1971, the composition has shifted towards industry and services over the past decades. The informal sector has become the engine of growth for sustainable development in our economy and plays an important role in employment creation. Majority (84.9%) of employed labour in the country is engaged in informal sector where females (96.6%) are more involved than the males (78.4%) (Labour Force Survey 2022).

The micro-enterprise (ME) has been playing a significant role in relieving hunger, ensuring good health, and building foundation for inclusive and sustainable economic growth, and sustainable industrialization. Majority of Bangladeshi youths are either employed in the informal sector or self-employed with low income and productivity. Continuous expansion of the micro-enterprise has been contributing to poverty alleviation but it needs further improvement for the sustainable growth. In order to facilitate the growth of micro-enterprise, Palli Karma-Sahayak Foundation (PKSF) initiated the Agrosor program in 2001 to offer financing support for the MEs through its Partner Organizations (POs). In continuation of this, PKSF has been providing financial and technical support to strengthen the micro-enterprises through various projects; such as Micro-Finance and Technical Support (MFTS), Finance for Enterprise Development and Employment Creation (FEDEC), Promoting Agricultural Commercialization and Enterprises (PACE), Rural Microenterprise Transformation Project (RMTP), Sustainable Enterprise Project (SEP) and Skills for Employment Investment Program (SEIP) among others.

In 2018, the World Bank in association with PKSF, carried out a Gap Analysis Study in order to identify the gaps in the services provided under the micro-enterprise programs/projects so that these could be properly addressed. From this study, it was found that the micro-enterprises in the informal sector are constrained by lack of skills of the entrepreneurs including life-skills, entrepreneurial skills and technical skills; lack of access to finance especially for the start-ups and those entrepreneurs are falling behind; use of low-technology which causes lower productivity; and substantial gender gaps in labour market outcomes among others. In addition to that, many skilled youths including females prefer to be self-employed; however, due to lack of business knowledge and start-up capital constraints they are unable to do so. The need for targeted labour market programs for those in the informal sector, especially urban and peri-urban youth, has been made more urgent by the recent COVID-19 crisis, due to the urban and peri-urban informal sector being disproportionately affected by the COVID related shocks. In this context, PKSF has undertaken the ‘Recovery and Advancement of Informal Sector Employment (RAISE)’ Project in February 2022 jointly financed by the World Bank and PKSF. The RAISE project aims to enhance employability and improve productivity in the informal sector while providing financial assistance to 225,500 low-income youths and micro-entrepreneurs in urban and peri-urban areas across the country. PKSF is implementing the project through its 89 partner organizations (POs).

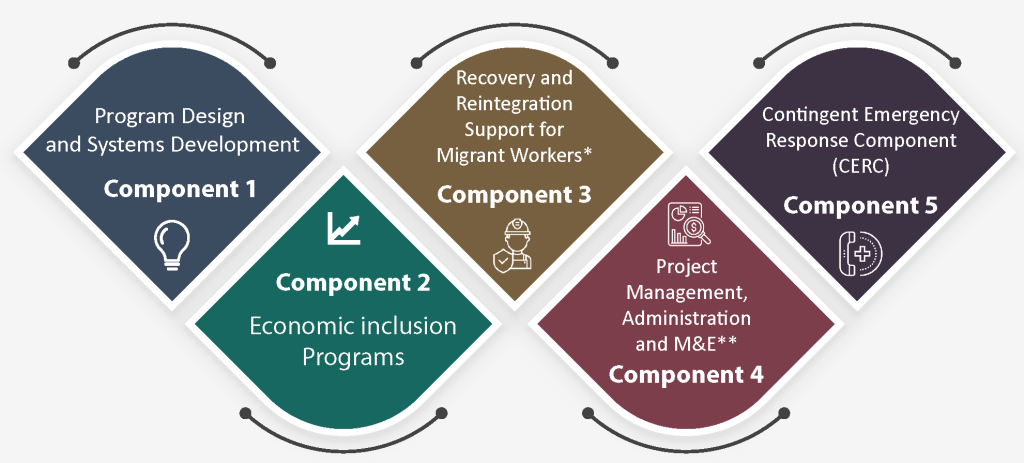

Project Components

*This component is being solely implemented by WEWB

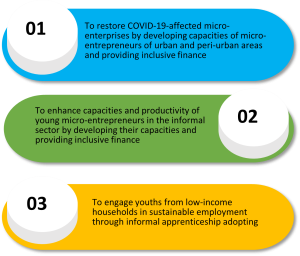

Objective: Objective: The overall objective of the project implemented by PKSF is to enhance the access to earning opportunities for low-income youth, including COVID-affected youth in urban and peri-urban areas.

Specific Objectives:

Target Participants | Total Number of Participants |

Low-income youth accessing apprenticeship track* | 73,000 |

Low-income youth and micro-entrepeneurs accessing business management track* | 96,000 |

COVID-affected micro-entrepreneurs receiving microfinance support | 56,500 |

*35% of participants under this category will be female

Youths from disadvantaged groups, e. g. Dalit; ethnic minorities; inhabitants of char, haor, hill tracts, tea estate and coastal areas; and persons with disabilities will get priority to be enrolled in this project.

Economic Inclusion Programs under the RAISE Project

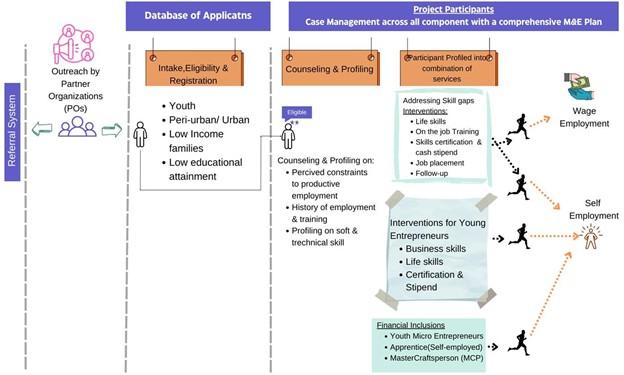

The project aims to enhance economic inclusion of low-income youth and micro-entrepreneurs in urban and peri-urban areas. The services include skill-acquisition through informal apprenticeship, business management training, and access to credit, among other interventions. The project participants are low-income, less educated youth living in urban and peri-urban areas. The potential path of a participant for the economic inclusion program can be illustrated as follows.

![]()

Inclusive Finance:COVID-affected micro-entrepreneurs who were previous borrowers of the PO and are in need of financial assistance will receive inclusive finance on easy terms under the project to restore their enterprise/business. The project is also providing inclusive finance for the expansion of microenterprises by young micro-entrepreneurs. In addition, the project will finance new microenterprises by the apprentices who have successfully completed the apprenticeship program under the project. The master craftspersons (MCPs) included in the project will be eligible for loans.

Capacity Enhancement:

Risk Management and Business Continuity (RMBC) Training COVID-19 Affected Micro-entrepreneurs: In order to develop the capacities of these micro-entrepreneurs, they will be provided training on Risk Management and Business Continuity. Informal sector micro-entrepreneurs are exposed to various risk factors including man-made and natural disasters but do not usually have the capacity to deal with those. Through this training, the micro-entrepreneurs will learn how to incorporate risk management, coping, and business continuity in the event of a shock. This will help the local youth build their capacities to secure sustainable employment for themselves which will, in turn, help them to support their families and contribute to national economy.

Business Management and Entrepreneurship Development (BMED) Training for Young Micro-entrepreneurs: 84% of total labour force is engaged in the informal sector (Labour Force Survey 2023). Taking into account the importance of this sector, PKSF will provide training on Business Management and Entrepreneurship Development to young micro-entrepreneurs who are lagging behind in order to develop their capacities on Risk Management & Business Continuity, Life-skills Development, Generic Business Management and Occupation specific Technical Skills Development.

Apprenticeship Program: ‘Ustad-shagred’ system is a centuries old system of transferring skills from generation to generation and is mutually beneficial for both ustads (masters) and shagreds (apprentices). Under this project, youth from low-income households will be matched with skilled and experienced Master Craftsperson (MCP) selected by the POs according to the eligibility and selection criteria to host an apprentice. The apprentice will receive on-the-job training under the MCP and will also receive Life-skills Development training from a skilled trainer in order to develop his/her capacity to ensure sustainable wage employment.

Community Outreach: To ensure inclusion of appropriate target participants (YME and apprentices) in the project, Project Implementation Unit (PIU) at POs are conducting outreach activities such as courtyard meetings, meetings at marketplaces, miking, community radio.

Case Management System (CMS): The Case Management System (CMS) under the RAISE project is a holistic digital approach designed to streamline of the information management of project participants. It enables secure registration, training management, assessment, certification, employment tracking, and allowance disbursement. By automating processes and ensuring real-time monitoring, the CMS enhances transparency, efficiency, and decision-making for the future program plan. It will maintain data-driven historical evidence to track individual progress and outcomes, ensuring better program oversight and improved support for participants throughout their engagement with the RAISE project. The CMS will be an integral part of PKSF's Integrated Management Information System (IMIS).

Psychometric Profiling: Psychometric Profiling is the process of understanding an individual’s personality, behavioural style, and reasoning skills using a data-directed objective and structured approach. The main aim of using psychometric profiling in RAISE project is to ascertain an entrepreneur’s entrepreneurial ability and creditworthiness, i.e., personality traits, aptitude, attitude, intelligence, motivation, etc. related to business development. Proper application of this tool can be effective in providing start-up capital loan to new entrepreneurs and microenterprise loans to the established micro-entrepreneurs. The POs have been using various methods to determine the creditworthiness of the potential borrowers which is mostly based on the judgement of the lender. The Psychometric profiling, on the other hand, lends a data-driven approach to screening by providing a comparative view of all entrepreneurs.

Psychosocial Counselling: The project will provide psychosocial counselling support to the project participants especially the apprentices and young micro-entrepreneurs.

Financial Management System (FMS): The Financial Management System (FMS) of RAISE, modernizes fund management by automating budgeting, loan processing, payments, and reporting. It enables secure, efficient, and transparent financial transactions with real-time dashboards and audit trails. The system streamlines fund allocation, disbursement, and repayment tracking while ensuring compliance. The FMS supports data-driven decision-making, strengthens financial oversight, and enhances accountability, ultimately improving the effectiveness and transparency of financial operations under the RAISE project. The FMS will be an integral part of PKSF's Integrated Management Information System (IMIS).

Employment Support Service: The project will provide support to the apprentices, who successfully complete the apprenticeship, in securing wage-employment in corresponding trade. Those who opt for self-employment will have access to finance from the respective POs. Upon completing the apprenticeship program, 10% of the apprentices will receive finance to start their own enterprise.

Services to be Provided through this Project:

Target Participants | Major Services/Tasks | Details | Selection Criteria |

Micro-entrepreneurs affected by Covid-19 pandemic or other shocks

56,500 | Inclusive finance to restore the businesses of micro-entrepreneurs | o Reduced service charge for Agrosor-RAISE loan | Due to Covid-19 pandemic or other shocks (including but not limited to natural disasters or health shocks) the ME has encountered one or more of the followings:

|

Risk Management & Business Continuity (RMBC) training | o Training duration: 3 days/12 hours o Stipend for training participants | ||

Youth and micro-entrepreneurs from low-income households

96,000 | Inclusive finance to expand the business/enterprise | o Reduced service charge for Agrosor-RAISE loan |

Age and educational requirements can be waived for women and members of disadvantaged communities. |

Business Management & Entrepreneurship Development (BMED) training | o Training duration: 96 hours o Stipend for training participants | ||

NEET Youth from low-income households

73,000

*NEET=not in employment, education or training | Technical Skills Development under Master Craftsperson (MCP) Life-skills Development under skilled trainer Support for wage and self-employment | o Training duration: 6 months o Stipend for apprentices o Stipend for Recognition for Prior Learning (RPL) test (10% of the participants under this category) | For Apprentices:

Age and educational requirements can be waived for women and members of disadvantaged communities. *To be eligible for inclusive finance, minimum age has to be 18 |

Inclusive finance upon successful completion of apprenticeship to start a new business/enterprise (10% of the participants under this category) | o Reduced service charge for Agrosor-RAISE loan | ||

Risk Management & Business Continuity (RMBC) training | o Training duration: 3 days/12 hours o Stipend for training participants |

Master Craftsperson (MCP) for Apprenticeship Program under the RAISE Project

A total of 21,000 Master Craftspersons (MCPs) will be included in the project. Selected MCPs will be eligible to receive inclusive financing at a reduced service charge to expand their businesses. In addition, each MCP will receive a monthly stipend for every apprentice they host.

The selection criteria for the MCPs are as follows:

- Age: minimum 25 years

- Have minimum 5 years of relevant experience

- Have a Junior School Certificate (JSC)

- 1 to 3 apprentices can work together in the enterprise

- The working environment has to be hygienic and decent

- Enterprise type: listed trade under this project

- Willingness and capacity to follow project guidelines (Gender policy, OHS guideline, social & environmental guideline & GRM policy)

Loan Disbursement

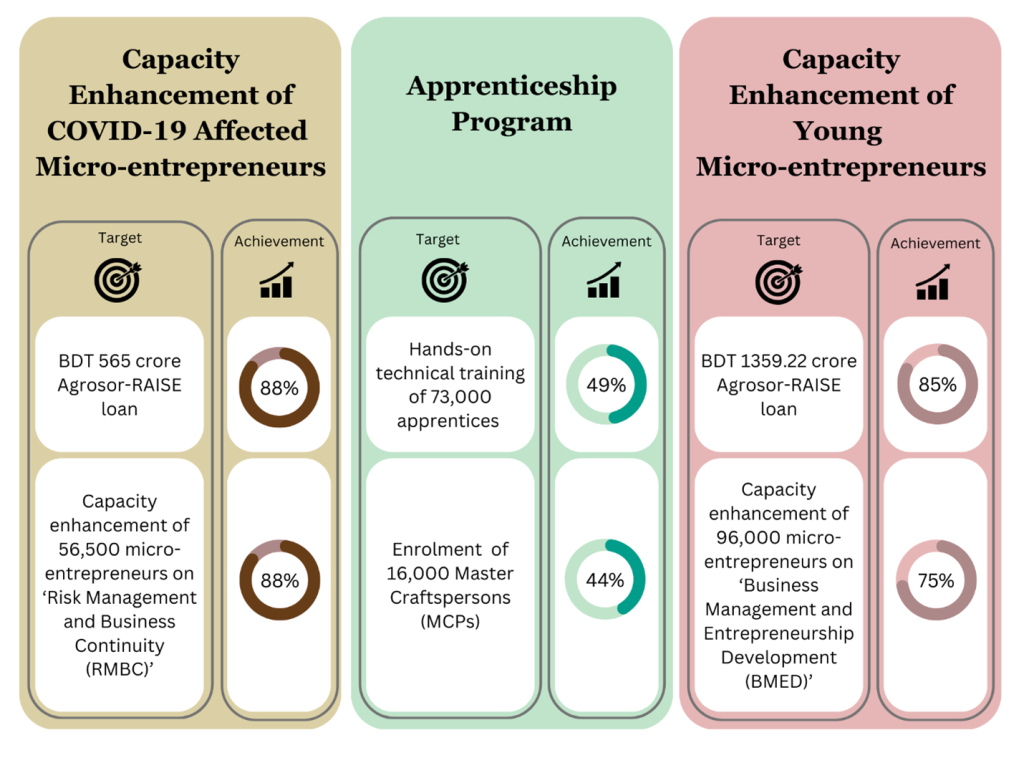

Up to 31 August 2025, PKSF has disbursed BDT 1888.38 crore under this project to RAISE project implementing POs to provide micro-entrepreneurs supported by the project with access to inclusive finance.

Within this time period, the POs have disbursed BDT 1711.54 crore among 138,400 micro-entrepreneurs, of which 80.7% are female.

Hands-on Technical Training for Apprentices

Till 31 August 2025, 26,796 (40% female) apprentices have completed hands-on technical training on respective trades under the direct supervision of Master Craftspersons (MCPs). 8,995 apprentices are currently enrolled in the apprenticeship program. Alongside technical skills, apprentices also gain valuable knowledge on managing and operating a successful enterprise.

Till 31 August 2025, 26,796 (40% female) apprentices have completed hands-on technical training on respective trades under the direct supervision of Master Craftspersons (MCPs). 8,995 apprentices are currently enrolled in the apprenticeship program. Alongside technical skills, apprentices also gain valuable knowledge on managing and operating a successful enterprise.

Capacity Enhancement of Young Micro-entrepreneurs

As of 31 August 2025, a total of 72,063 young micro-entrepreneurs (72.9% female) under the project have been provided with ‘Business Management and Entrepreneurship Development’ training. Through this training, entrepreneurs gain knowledge on entrepreneurship development, business environment, employee management in microenterprises, business planning and financing, and business expansion through various group exercises.

under the project have been provided with ‘Business Management and Entrepreneurship Development’ training. Through this training, entrepreneurs gain knowledge on entrepreneurship development, business environment, employee management in microenterprises, business planning and financing, and business expansion through various group exercises.

In addition to classroom sessions, the training activities also include field visits, allowing entrepreneurs to observe successful enterprises and exchange experiences with successful entrepreneurs about enterprise management.

Capacity Enhancement of COVID-19 Affected Micro-entrepreneurs

The project is providing ‘Risk Management and Business Continuity (RMBC)’ training to COVID-19 affected micro-entrepreneurs to develop their capacity to overcome the impact of various unexpected disasters and mitigate the damage to the microenterprises. Till 31 December 2023, the project has developed the capacity of 49,963 micro-entrepreneurs, of which 77.5% are female.

The project is providing ‘Risk Management and Business Continuity (RMBC)’ training to COVID-19 affected micro-entrepreneurs to develop their capacity to overcome the impact of various unexpected disasters and mitigate the damage to the microenterprises. Till 31 December 2023, the project has developed the capacity of 49,963 micro-entrepreneurs, of which 77.5% are female.

The micro-entrepreneurs get to learn about entrepreneurship development, risk management, income-expenditure calculation, and developing business plan through various games and group exercises. Entrepreneurs are applying the knowledge they've gained to recognize potential risks in managing their enterprises, thereby ensuring the continuity of their businesses.

Community Outreach Activities

The POs are conducting outreach activities such as courtyard meetings, meetings at marketplaces, miking, community radio in their respective project areas. So far, the project has directly reached 7,27,500 community members with information on economic inclusion.

The POs are conducting outreach activities such as courtyard meetings, meetings at marketplaces, miking, community radio in their respective project areas. So far, the project has directly reached 7,27,500 community members with information on economic inclusion.

Orientation for Master Craftspersons (MCPs)

MCPs are accomplished and thriving entrepreneurs who rank among the top experts in their respective fields. The apprentices receive training under the direct supervision of the MCPs. The project provides a 2-day orientation to the MCPs on how to conduct the training under the apprenticeship program. Till 31 August 2025, the project has provided orientation to 6,975 MCPs.

Capacity Development of PIU and PO Officials as Trainers

The project has been organized various capacity enhancement programs for the Project Implementation Unit (PIU) at PO level as well as for selected officials from the POs’ training pool. So far, more than 500 PIU and PO officials have taken part in these capacity building activities.

The project has been organized various capacity enhancement programs for the Project Implementation Unit (PIU) at PO level as well as for selected officials from the POs’ training pool. So far, more than 500 PIU and PO officials have taken part in these capacity building activities.

The project provided Training of Trainer (ToT) on BMED, orientation on RAISE Project Implementation, Financial Management, Life-skills Development, and Apprenticeship Program.

Virtual Meeting on “Gender-Based Violence and Grievance Redress Mechanism”

On 2 September 2025, a virtual awareness session on “Gender-Based Violence and Grievance Redress Mechanism” was held under the RAISE project. Over 300 officials from partner organizations participated.

In his opening remarks, Project Coordinator and General Manager (Programs) Dilip Kumar Chakravorty stressed the importance of confidentiality and speedy resolution of complaints. Deputy Project Coordinator Golam Gilane and other project unit staff also attended. Social Development Specialist Md. Dewan Zinnah delivered a detailed presentation on grievance procedures. Participants shared field experiences, gaining clearer insights into preventing gender-based violence and effectively handling complaints.

In his opening remarks, Project Coordinator and General Manager (Programs) Dilip Kumar Chakravorty stressed the importance of confidentiality and speedy resolution of complaints. Deputy Project Coordinator Golam Gilane and other project unit staff also attended. Social Development Specialist Md. Dewan Zinnah delivered a detailed presentation on grievance procedures. Participants shared field experiences, gaining clearer insights into preventing gender-based violence and effectively handling complaints.

Virtual Meeting on Target Beneficiary Selection

Also on 2 September 2025, a virtual session on “Selection of Target Participants (Community Outreach)” was held under the RAISE project, chaired by Project Coordinator and General Manager (Programs) Dilip Kumar Chakravorty.

Discussions covered community outreach progress, online data entry, capacity building activities, and employment updates. Presentations were made by MIS Specialist Ashoka Das and Program Officer (Case Management) Md. Jahidul Islam. Around 270 officials from partner organizations, along with project implementation unit staff, participated. The session emphasized ensuring regular and reliable data entry, identifying field-level challenges, and taking specific steps for effective trainee selection and smooth information flow.

Orientation on the CMS, an integral part of PKSF’s IMIS

From 19–21 August 2025, a virtual orientation was held on the Case Management System (CMS) developed under the RAISE project. More than 250 participants, including MIS officers, branch managers, and case management officers from 50 partner organizations, attended the orientation.

Deputy Project Coordinator Golam Gilane inaugurated the session, and project coordinators and focal persons were also present. On August 21, Project Coordinator Dilip Kumar Chakravorty chaired the closing session.

CMS is an integral part of PKSF’s Integrated Management Information System (IMIS) under the wider MIS framework. It enables enrollment, progress tracking, and overall information management more effectively and modernly. A consulting firm, “Nano Information Technology,” developed the system and conducted the orientation. Earlier, the system had been piloted with 20 selected partner organizations.

National and International Youth Day 2025 Celebrations

On 12 August 2025, PKSF marked National and International Youth Day with vibrant celebrations held across the country in partnership with RAISE Partner Organizations.

Apprentices in training, program graduates, young entrepreneurs, officials from partner organizations, and representatives from government and private institutions took part in colorful rallies. Carrying festoons, placards, and banners, participants marched through local streets to promote the importance of skills development and decent employment for youth.

|  |

|  |

The rallies were followed by discussions highlighting the contributions of PKSF and the RAISE project in youth employment, as well as the broader significance of Youth Day. While most POs arranged rallies and discussions, others organized complementary activities, including certificate distribution ceremonies, seminars, tree-planting campaigns, and cultural programs.

Altogether, 11,868 youths from 83 POs participated in the celebrations nationwide, underscoring the project’s reach and its role in empowering the next generation.

Orientation Meeting with Newly Selected Partner Organizations

Starting in July 2025, the RAISE project included 19 new Partner Organizations (POs) to expand its skill development activities in marginalized areas. On 3 July 2025, an orientation meeting was held at PKSF with representatives of these organizations on RAISE project operations and implementation strategies.

In the opening session, PKSF Managing Director Md. Fazlul Kader emphasized the need to prepare the workforce with skills that align with future labor market demands, both domestic and international. In this context, he noted that PKSF, through the RAISE project, is transforming unemployed youth into skilled manpower using the ustad-shagred model. The project also supports young micro-entrepreneurs in expanding their businesses.

In the opening session, PKSF Managing Director Md. Fazlul Kader emphasized the need to prepare the workforce with skills that align with future labor market demands, both domestic and international. In this context, he noted that PKSF, through the RAISE project, is transforming unemployed youth into skilled manpower using the ustad-shagred model. The project also supports young micro-entrepreneurs in expanding their businesses.

The orientation familiarized the Chief Executives and focal persons of the POs with the project’s objectives, implementation framework, and operational guidelines. In the closing session, Deputy Managing Director Md. Hasan Khaled highlighted the importance of efficient grant management and quality assurance in implementation.

General Manager (Program) and Project Coordinator Dilip Kumar Chakravorty, panel leaders, and officials from the project management unit also participated in the meeting. Deputy Project Coordinator Golam Gilane presented on “Project Introduction and Implementation Strategies.”

PKSF–World Bank Survey: Enhancing Youth Skills and Empowerment through RAISE Apprenticeship Program

A survey jointly conducted by PKSF and the World Bank on the outcomes of the RAISE apprenticeship program shows that the initiative plays an important role in youth employment, skills development, and social empowerment. Based on data from 2,529 apprentices across the first three cohorts/intakes of the apprenticeship program, the survey found that 64% entered wage employment, 24% became self-employed, and unemployment fell from 13% in cohort 1 to just 7% in cohort 3. Among those employed, 81% secured full-time jobs, and 59% were employed within one month of completing their training. Both apprentices and master craftspeople expressed strong satisfaction with training quality and management. About 98% of apprentices rated the training as “excellent” or “very good,” and most master craftspeople preferred hiring their own apprentices.

In addition, 93% of apprentices reported increased self-confidence, and 90% felt their social status improved after joining the program. However, challenges remain, such as the lack of modern equipment, capital constraints, and social barriers to women entering nontraditional trades. The study recommended extending training duration by trade, strengthening job linkages, including digital and emerging trades, and adopting gender-sensitive initiatives. Overall, the survey confirms that the RAISE apprenticeship program is opening new horizons for employment and confidence among unemployed youth.

The World Bank presented the survey findings at a meeting held on 2 July 2025 at PKSF. Deputy Managing Director Md. Hasan Khaled stated that the results would serve as a guiding document for future planning and to make the apprenticeship program more effective and sustainable.

UAT session Case Management System

On 23 and 24 June 2025, a User Acceptance Testing (UAT) session was held at PKSF Bhaban on the draft module of the Financial Management System (FMS), being developed under the RAISE project as part of PKSF’s integrated information management system. The session was inaugurated by Md. Hasan Khaled, Deputy Managing Director of PKSF. Panel leaders from PKSF’s Program Division, panel’s desk officers, and officials from I&T, Finance, Audit, and the RAISE Project Management Unit attended the session and shared feedback on the FMS.

Earlier, on 1 and 2 June 2025, a virtual UAT session was conducted with participation from officials of 20 Partner Organizations. Focal persons/loan coordinators, and officers from MIS and Accounts departments of the POs provided their feedback on the system.

As part of PKSF’s digitization efforts, field-level stakeholder data modules are being integrated into its Decision Support System (DSS). Nano Information Technology is developing two modules under PKSF’s Integrated Management Information System (IMIS): the Case Management System (CMS) and the Financial Management System (FMS). The FMS will store data on loans, grants and overall financial management at PKSF level, enabling more effective decision-making through analysis of such information.

Training workshop on financial management

A day-long training workshop on financial management was held on 19 June 2025 at PKSF Bhaban to maintain transparency and accuracy in financial management at the field level and enhance the capacity of Accounts Officers of the RAISE Project Implementation Units at Partner Organizations. The event featured practical discussions, experience sharing, and technical guidance on key aspects of financial operations.

A day-long training workshop on financial management was held on 19 June 2025 at PKSF Bhaban to maintain transparency and accuracy in financial management at the field level and enhance the capacity of Accounts Officers of the RAISE Project Implementation Units at Partner Organizations. The event featured practical discussions, experience sharing, and technical guidance on key aspects of financial operations.

In his opening remarks, Deputy Managing Director of PKSF Md. Hasan Khaled highlighted the importance of precise bookkeeping for smooth project implementation and encouraged the accounts officers to remain committed to their responsibilities.

A total of 30 Accounts Officers from the Partner Organizations participated in the training. General Manager (Operations) and RAISE Project Coordinator Dilip Kumar Chakravorty delivered the welcome address. Deputy Project Coordinator of RAISE Golam Gilane presented an overview of project activities.

Technical sessions were led by Financial Management Specialist Md. Tarikul Islam, Accounts Officer Suma Saha and Assistant Accounts Officers Md. Atikur Rahman, Anamika Laskor, and Sharmin Sultana of RAISE Project Management Unit.

WB delegation applauds youth skill and entrepreneurship development through RAISE

A high-level delegation from the World Bank (WB) visited field-level activities of the RAISE project in Dhamrai and Savar upazilas of Dhaka on 17 June 2025. As part of the visit, the delegation inspected various activities implemented through Partner Organizations and interacted with youths who received training under the project.

A high-level delegation from the World Bank (WB) visited field-level activities of the RAISE project in Dhamrai and Savar upazilas of Dhaka on 17 June 2025. As part of the visit, the delegation inspected various activities implemented through Partner Organizations and interacted with youths who received training under the project.

WB’s Senior Finance Officer Tipawan Bhutaprateep said that, this project provides opportunities to people to explore their potential and it was truly inspiring to witness firsthand the enthusiasm and pride of the micro-entrepreneurs in their work. “The impact they are making in their communities is incredible, and it’s heartening to see how lifting one person can have a ripple effect, lifting many others along with them,” she added.

WB’s Senior Finance Officer Tipawan Bhutaprateep said that, this project provides opportunities to people to explore their potential and it was truly inspiring to witness firsthand the enthusiasm and pride of the micro-entrepreneurs in their work. “The impact they are making in their communities is incredible, and it’s heartening to see how lifting one person can have a ripple effect, lifting many others along with them,” she added.

PKSF, British Council mull collaboration on youth’s English skills

Alongside technical skills, soft skills, particularly language proficiency, are extremely important in developing a skilled workforce. English language competency can significantly enhance the employability of young people in both national and international labor markets, said PKSF Managing Director Md. Fazlul Kader. He made these remarks during a meeting between PKSF and the British Council on 3 June 2025 at the PKSF Bhaban.

Alongside technical skills, soft skills, particularly language proficiency, are extremely important in developing a skilled workforce. English language competency can significantly enhance the employability of young people in both national and international labor markets, said PKSF Managing Director Md. Fazlul Kader. He made these remarks during a meeting between PKSF and the British Council on 3 June 2025 at the PKSF Bhaban.

From the British Council, Country Director Stephen Forbes and other senior officials attended the meeting. Md. Hasan Khaled, Deputy Managing Director of PKSF; Dilip Kumar Chakravorty, General Manager and Project Coordinator of RAISE; and officials from the RAISE Project Management Unit also attended the meeting.

News link: https://pksf.org.bd/pksf-british-council-mull-collaboration-on-youths-english-skills/

ERD Joint Secretary visits RAISE activities in Habiganj

Muhammad Rezaul Karim, Joint Secretary of the Economic Relations Division (ERD) of the Government of Bangladesh, attended a view exchange meeting in Moulvibazar on 25 May 2025 with participants of PKSF’s RAISE project, implemented through Partner Organization HEED Bangladesh.

Muhammad Rezaul Karim, Joint Secretary of the Economic Relations Division (ERD) of the Government of Bangladesh, attended a view exchange meeting in Moulvibazar on 25 May 2025 with participants of PKSF’s RAISE project, implemented through Partner Organization HEED Bangladesh.

During the session, young micro-entrepreneurs, apprentices, and Master Craftspersons shared their personal stories, highlighting how the project’s training, mentoring, and support have enhanced their skills, boosted their confidence, and opened up new employment opportunities.

General Manager of PKSF and RAISE Project Coordinator Dilip Kumar Chakravorty, Deputy Project Coordinator Golam Gilane, and other relevant officials were present at the meeting.

On the same day, the Joint Secretary and the PKSF team also attended the closing ceremony of a Life Skills Development training conducted under the RAISE project.

Discussion meeting on ‘Changing Nature of Livelihoods’

A discussion meeting on ‘Changing Nature of Livelihoods’ was held at PKSF Bhaban on 14 May 2025. During the meeting, the World Bank presented a summary of their research titled ‘Informal Firms in Urban Bangladesh’. The event was chaired by Md. Hasan Khaled, Deputy Managing Director of PKSF, and attended by senior officials, project coordinators, members of research and development unit and RAISE Project Management Unit.

World Bank representatives highlighted PKSF’s important contribution to Bangladesh’s economic development through its grassroots livelihood initiatives. They emphasized the potential for PKSF and the World Bank to collaborate in establishing PKSF as a Center of Excellence through evidence-based documentation.

On 13 May 2025, the same World Bank team visited various livelihood programs implemented by Naria Unnayan Samity (NUSA), a PKSF partner in Shariatpur. The team met with char-based micro-entrepreneurs and visited a health camp under the ENRICH program. They also held discussions with RAISE apprentices, Master Craftspersons, and young micro-entrepreneurs at NUSA’s head office and later visited the workplaces of apprentices who completed their training.

The World Bank team included Senior Economist Ihsan Azwad, Senior Social Protection Specialist and RAISE Task Team Leader Aneeka Rahman, Economist Aishwarya Patil, and Operations Consultant Masud Rana. They were accompanied by PKSF’s General Manager (Operations) and RAISE Project Coordinator Dilip Kumar Chakravorty, Deputy Project Coordinator Golam Gilane, other members of the RAISE Project Management Unit, and Executive Director of NUSA Majeda Shawkat Ali along with relevant project staff.

WB ESF team visits RAISE activities

The World Bank’s Environmental and Social Framework (ESF) team visited field-level activities of the RAISE project in Tangail and Bogura districts on 28 and 29 April 2025. On the first day, the team visited the apprenticeship program in ‘Aluminium Fabrication’ and ‘Small Engineering & Metal Works’ trades implemented by partner organization BASA Foundation in Kaliakoir upazila.

The World Bank’s Environmental and Social Framework (ESF) team visited field-level activities of the RAISE project in Tangail and Bogura districts on 28 and 29 April 2025. On the first day, the team visited the apprenticeship program in ‘Aluminium Fabrication’ and ‘Small Engineering & Metal Works’ trades implemented by partner organization BASA Foundation in Kaliakoir upazila.

During the visit, the ESF team expressed satisfaction with the project's efforts in promoting occupational health and safety (OHS) practices, grievance redress mechanisms (GRM), inclusive participant selection, skill development, and career planning.

The World Bank delegation included Country Management Unit representative Nabeel A. Shaiban, Environment Specialists Bushra Nishat and Sharlin Hossain, and Senior Social Development Specialist Shariful Islam. From PKSF, Assistant General Manager A.K.M. Zahirul Haque, Deputy Project Coordinators Golam Gilane and S. M. Khaled Mahfuz, along with officials from the Project Management Unit were present during the visit.

RAISE’s 3rd Coordination Meeting

RAISE project’s 3rd coordination meeting was held on 25 February 2025 at PKSF Bhaban. PKSF Chairman Zakir Ahmed Khan, who presided over the meeting emphasized on the need for quality training for the youth of Bangladesh and creation of decent employment opportunities abroad. PKSF

RAISE project’s 3rd coordination meeting was held on 25 February 2025 at PKSF Bhaban. PKSF Chairman Zakir Ahmed Khan, who presided over the meeting emphasized on the need for quality training for the youth of Bangladesh and creation of decent employment opportunities abroad. PKSF Managing Director Md Fazlul Kader highlighted the importance of developing a skilled workforce suited for technology-driven workplaces. Representatives from RAISE implementing POs participated in the meeting. Earlier, PKSF Deputy Managing Director AQM Golam Mawla inaugurated the meeting.

Managing Director Md Fazlul Kader highlighted the importance of developing a skilled workforce suited for technology-driven workplaces. Representatives from RAISE implementing POs participated in the meeting. Earlier, PKSF Deputy Managing Director AQM Golam Mawla inaugurated the meeting.

News link: https://pksf.org.bd/raise-project-coordination-meeting-held/

Courtesy Meeting of WB Global Director with PKSF Chairman

World Bank Global Director for Social Protection and Labor in the South Asia Region, Iffath Sharif highly praised Palli Karma-Sahayak Foundation (PKSF) for its significant contributions to poverty alleviation in Bangladesh, describing PKSF as a unique development organization in the country.

World Bank Global Director for Social Protection and Labor in the South Asia Region, Iffath Sharif highly praised Palli Karma-Sahayak Foundation (PKSF) for its significant contributions to poverty alleviation in Bangladesh, describing PKSF as a unique development organization in the country.

Iffath Sharif made these remarks during a courtesy meeting with PKSF Chairman Zakir Ahmed Khan and Managing Director Md Fazlul Kader at PKSF Bhaban on 17 February 2025.

She expressed satisfaction with the progress of the RAISE project and emphasized its potential for further expansion. She also highlighted the apprenticeship program under RAISE as an exemplary model for enhancing youth employability.

PKSF Chairman Zakir Ahmed Khan stressed on the importance of combining financial assistance with capacity development initiatives to ensure the effective utilization of loans by entrepreneurs.

Managing Director Md Fazlul Kader reaffirmed PKSF’s commitment to workforce development, particularly through capacity enhancement programs under the RAISE project.

News link: https://pksf.org.bd/bangladesh-can-take-pride-in-pksf-world-bank/

Implementation Support Mission for RAISE Project

A wrap-up meeting of the World Bank’s Implementation Support Mission for the RAISE project was held on 23 January 2025 at the Bangladesh Secretariat. The meeting was chaired by Md. Ahsan Kabir, Additional Secretary of the Financial Institutions Division (FID), and attended by officials from FID, PKSF, and representatives from the World Bank. The meeting reviewed the implementation progress of the RAISE project implemented by PKSF, and rated it as ‘satisfactory’. Prior to this, a pre-wrap-up meeting took place on 22 January 2025, chaired by PKSF MD Md. Fazlul Kader.

A wrap-up meeting of the World Bank’s Implementation Support Mission for the RAISE project was held on 23 January 2025 at the Bangladesh Secretariat. The meeting was chaired by Md. Ahsan Kabir, Additional Secretary of the Financial Institutions Division (FID), and attended by officials from FID, PKSF, and representatives from the World Bank. The meeting reviewed the implementation progress of the RAISE project implemented by PKSF, and rated it as ‘satisfactory’. Prior to this, a pre-wrap-up meeting took place on 22 January 2025, chaired by PKSF MD Md. Fazlul Kader.

As part of the mission, the World Bank delegation visited field-level activities under the RAISE project in Faridpur and Khulna districts on 19 and 20 January. The delegation emphasized the importance of cluster-based skill development and identified opportunities to expand the ongoing activities.

On the first day of the visit in Faridpur, the delegation met with young entrepreneurs supported by the partner organizations Amra Kaj Kori (AKK) and Society Development Committee (SDC). They also observed exhibitions showcasing products made by the entrepreneurs and apprentices. Additionally, the team visited RAISE’s apprenticeship program activities.

On the second day, the delegation visited the activities implemented by Nabolok Parishad in Khulna district. They held discussions with employers and master craftspersons who had mentored the young apprentices. The team also observed ongoing ‘Life Skills Development’ training sessions and inspected the apprenticeship programs and entrepreneurial initiatives undertaken by the youth.

The World Bank's Implementation Support Mission, conducted from 12 to 23 January 2025, assessed the overall progress of the RAISE project as ‘satisfactory’. The mission commenced with a kick-off meeting on 13 January 2025, chaired by PKSF MD Md. Fazlul Kader.

PKSF AMD visits RAISE activities in Bhola

PKSF Additional Managing Director Dr. Md. Jasim Uddin visited ‘Business Management and Entrepreneurship Development (BMED)’ training for young micro-entrepreneurs under the RAISE project on 23 January 2025 in Bhola District organized by Grameen Jano Unnayan Sangstha (GJUS).

PKSF Additional Managing Director Dr. Md. Jasim Uddin visited ‘Business Management and Entrepreneurship Development (BMED)’ training for young micro-entrepreneurs under the RAISE project on 23 January 2025 in Bhola District organized by Grameen Jano Unnayan Sangstha (GJUS).

While in conversation with the entrepreneurs, he encouraged them to apply the knowledge gained from the training to expand their enterprises and develop a diverse range of value-added products. He was accompanied on the visit by GJUS Executive Director Zakir Hossain Mohin and other project officials.

Inauguration of Psychometric Profiling program under RAISE project

As part of PKSF’s broader digitalization initiatives, the Psychometric Profiling program to assess the creditworthiness and entrepreneurial capabilities of microentrepreneurs under the RAISE project was launched on 18 December 2024. PKSF Chairman Zakir Ahmed Khan was the Chief Guest at the program at PKSF Bhaban, and it was moderated by PKSF Managing Director Md Fazlul Kader. Additional Managing Director Dr Md Jashim Uddin, senior officials, and members of the RAISE Project Management Unit were also present there.

The PKSF Chairman officially inaugurated the Psychometric Profiling program by activating the dashboard integrated with the PKSF server.

News link: https://pksf.org.bd/inauguration-of-psychometric-profiling-program-under-raise-project/

RAISE’s 2nd Coordination Meeting

RAISE project’s 2nd coordination meeting was held on 3 October 2024 at PKSF Bhaban. While speaking at the meeting, PKSF MD Md Fazlul Kader made the observations that capital formation is crucial for wealth creation, which is unattainable without increased income, efficient expenditure, and improved human skills. Without it, the target population remains trapped in the vicious cycle of poverty. To break this, linking capital with skills development and financial inclusion of microenterprises is essential. Microenterprises play a vital role in building a non-discriminatory, progressive nation.

Relevant officials from PKSF and its Partner Organizations, implementing RAISE, also participated in the program, offering insights and updates on different activities of the RAISE project.

Training of Facilitation (ToF) for the PKSF officials

59 trade-specific technical modules have been developed through the consulting firm Institute of Professional Training (IPTM) to enhance the effectiveness of the ongoing Business Management and Entrepreneurship Development (BMED) training aimed at developing the capacity of young micro-entrepreneurs. To further enrich these modules, feedback was collected from expert officials of PKSF and partner organizations on relevant subject matter through 4 workshops organized by the Project Management Unit from 4-7 November 2024. In continuation of this, the RAISE project organized a day-long Training of Facilitation (ToF) for the PKSF officials on 26 November 2024. Additionally, a virtual training on facilitation methods was conducted from 23-25 November 2024, where 240 officials from 70 partner organizations of the project participated. RAISE is providing 96-hour BMED training to 90,000 young micro-entrepreneurs. The training covers general business management, life skills, trade-based technical training, risk management, and business continuity.

59 trade-specific technical modules have been developed through the consulting firm Institute of Professional Training (IPTM) to enhance the effectiveness of the ongoing Business Management and Entrepreneurship Development (BMED) training aimed at developing the capacity of young micro-entrepreneurs. To further enrich these modules, feedback was collected from expert officials of PKSF and partner organizations on relevant subject matter through 4 workshops organized by the Project Management Unit from 4-7 November 2024. In continuation of this, the RAISE project organized a day-long Training of Facilitation (ToF) for the PKSF officials on 26 November 2024. Additionally, a virtual training on facilitation methods was conducted from 23-25 November 2024, where 240 officials from 70 partner organizations of the project participated. RAISE is providing 96-hour BMED training to 90,000 young micro-entrepreneurs. The training covers general business management, life skills, trade-based technical training, risk management, and business continuity.

Training of Trainers of Life Skills Development

Training of Trainers (ToT) on ‘Life Skills Development’ was organized in 14 batches during October-November 2024 with the aim to make the ongoing training activities under the project more effective. A total of 358 officials, including those from the Project Management Units and members of the training pool of the partner organizations, actively participated in the 4-day training. Experienced external trainers conducted sessions on communication skills, leadership development, stress management, conflict resolution, problem-solving techniques, decision-making, and more through games, group exercises, and discussions. Additionally, possible solutions were discussed through group presentation and discussion with the training participants in various sessions based on the observations identified in the field-level activities of the project by the partner organization. 73,000 apprentices and 96,000 young micro-entrepreneurs are receiving five-day training on ‘Life Skills Development’ under the project.

Training of Trainers (ToT) on ‘Life Skills Development’ was organized in 14 batches during October-November 2024 with the aim to make the ongoing training activities under the project more effective. A total of 358 officials, including those from the Project Management Units and members of the training pool of the partner organizations, actively participated in the 4-day training. Experienced external trainers conducted sessions on communication skills, leadership development, stress management, conflict resolution, problem-solving techniques, decision-making, and more through games, group exercises, and discussions. Additionally, possible solutions were discussed through group presentation and discussion with the training participants in various sessions based on the observations identified in the field-level activities of the project by the partner organization. 73,000 apprentices and 96,000 young micro-entrepreneurs are receiving five-day training on ‘Life Skills Development’ under the project.

WB ‘overwhelmed’ by PKSF’s success in employment generation for youth

A World Bank (WB) delegation visited the field-level interventions of the RAISE project in Rangpur and Dinajpur districts from 20 to 21 May 2024 under the ‘Environment and Social Standard 10 and Citizen Engagement Mission’.

A World Bank (WB) delegation visited the field-level interventions of the RAISE project in Rangpur and Dinajpur districts from 20 to 21 May 2024 under the ‘Environment and Social Standard 10 and Citizen Engagement Mission’.

During this visit, the mission praised PKSF’s project for creating employment opportunities for the youth from low-income communities in Bangladesh. “We are overwhelmed by the extent of the success of RAISE project. It is not only creating job opportunities for the youth but also helping them earn respect in their own communities” said the WB delegation. The delegates also mentioned that the success of the project would not be possible without PKSF’s strong guidance and support to its Partner Organizations.

News link: https://pksf.org.bd/wb-praises-pksfs-project-for-creating-employment-opportunities-for-youth/

The World Bank evaluates RAISE project ‘satisfactory’

The World Bank conducted the ‘Mid-term Review (MTR) Mission’ for the Recovery and Advancement of Informal Sector Employment (RAISE) project from 18 March 2024 to 04 April 2024. The mission evaluated the progress of PKSF’s RAISE project as satisfactory.

The World Bank conducted the ‘Mid-term Review (MTR) Mission’ for the Recovery and Advancement of Informal Sector Employment (RAISE) project from 18 March 2024 to 04 April 2024. The mission evaluated the progress of PKSF’s RAISE project as satisfactory.

News link: https://pksf.org.bd/the-world-bank-evaluates-pksf-project-satisfactory/

WB Country Director commends RAISE activities

Abdoulaye Seck, the World Bank (WB) Country Director for Bangladesh and Bhutan visited field-level interventions of the RAISE project in Jashore on 5 March 2024 and highly appreciated PKSF’s activities.

Abdoulaye Seck, the World Bank (WB) Country Director for Bangladesh and Bhutan visited field-level interventions of the RAISE project in Jashore on 5 March 2024 and highly appreciated PKSF’s activities.

He said, “… the urban informal sector, where a vast majority of the poor people are engaged, played an important part in reducing poverty in Bangladesh. However, aspiring workers face challenges, including limited technical skills, social norms, and access to finance. Moreover, the COVID-19 pandemic hit (these) sectors, creating hardships for the employed in the informal sector ... By providing a comprehensive package of skills, counseling, and financial support, the RAISE project helped these workers to improve their capabilities and enhance their income.”

PKSF DMD visits RAISE activities

Md. Hasan Khaled, Deputy Managing Director of PKSF, visited the RAISE project’s activities in Dhaka and Manikganj district on 28 February 2024. Expressing satisfaction following the visit, he recommended maintaining the ongoing course of progress for the project.

Md. Hasan Khaled, Deputy Managing Director of PKSF, visited the RAISE project’s activities in Dhaka and Manikganj district on 28 February 2024. Expressing satisfaction following the visit, he recommended maintaining the ongoing course of progress for the project.

PKSF signs MoU with Wage Earners’ Welfare Board

A Memorandum of Understanding (MoU) was signed between Palli Karma-Sahayak Foundation (PKSF) and Wage Earners’ Welfare Board (WEWB) to ensure mutual cooperation between the two organizations to facilitate the effective implementation of field-level activities under the RAISE project, implemented by PKSF and WEWB. Under this MoU, mutual cooperation will be extended for ensuring Recognition of Prior Learning (RPL) certification of youths who complete the apprenticeship program under PKSF’s RAISE project, providing necessary information for safe overseas employment to interested youths who completed RAISE’s apprenticeship program and encouraging youths and returnee migrants to become self-employed.

A Memorandum of Understanding (MoU) was signed between Palli Karma-Sahayak Foundation (PKSF) and Wage Earners’ Welfare Board (WEWB) to ensure mutual cooperation between the two organizations to facilitate the effective implementation of field-level activities under the RAISE project, implemented by PKSF and WEWB. Under this MoU, mutual cooperation will be extended for ensuring Recognition of Prior Learning (RPL) certification of youths who complete the apprenticeship program under PKSF’s RAISE project, providing necessary information for safe overseas employment to interested youths who completed RAISE’s apprenticeship program and encouraging youths and returnee migrants to become self-employed.

Dilip Kumar Chakravorty, General Manager (Programs) and Project Coordinator, RAISE, signed the MoU on behalf of PKSF and Sourendra Nath Saha, Joint Secretary and RAISE Project Director signed it on behalf of WEWB. Arif Ahmed Khan, Joint Secretary and Director (Admin & Development), WEWB; Golam Gilane, Deputy Project Coordinator, RAISE, PKSF, and other officials from the Project Management Unit were present on the occasion.

WEWB is implementing Recovery and Advancement of Informal Sector Employment (RAISE): Reintegration of Returnee Migrants project financed by the World Bank.

News Link: https://pksf.org.bd/pksf-signs-mou-with-wage-earners-welfare-board/

WB’s Implementation Support Mission

PKSF’s RAISE project is making a positive impact in creating young microentrepreneurs. The World Bank Resident Representatives in Bangladesh commented after visiting the field-level activities of the RAISE project in Sirajganj, Bogra and Naogaon districts on 28 and 29 January 2024.

PKSF’s RAISE project is making a positive impact in creating young microentrepreneurs. The World Bank Resident Representatives in Bangladesh commented after visiting the field-level activities of the RAISE project in Sirajganj, Bogra and Naogaon districts on 28 and 29 January 2024.

After the visit, Aneeka Rahman said that they deeply appreciate the excellent work on the ground that they witnessed by PKSF’s Partner Organizations. The impact of the RAISE project on young micro-entrepreneurs and unemployed youth, as well as the innovative business practices they have adopted, will contribute to the country’s green and resilient development.

News link: https://pksf.org.bd/pksf-makes-positive-impact-on-creating-young-mes-wb-delegation/

AMD visits PKSF’s field-level interventions in Sherpur District

Additional Managing Director of PKSF Dr Md Jashim Uddin visited the activities of the RAISE project being implemented through Rural Development Organization (RDS), a Partner Organization (PO) of PKSF, in Sherpur district on 23 January 2024. He visited the Apprenticeship Program on ‘Driving cum Auto Mechanics’ where 3 youths are receiving hands-on technical training under the supervision of an Ustad (Master Craftsperson).

News link: https://pksf.org.bd/amd-visits-pksfs-field-level-interventions-in-sherpur-district/

Visit of FID Secretary

Mr. Sheikh Mohammad Salim Ullah, Secretary, Financial Institutions Department, Ministry of Finance, Bangladesh visited the field-level interventions of the RAISE project in Feni on 24 December 2023.

Mr. Sheikh Mohammad Salim Ullah, Secretary, Financial Institutions Department, Ministry of Finance, Bangladesh visited the field-level interventions of the RAISE project in Feni on 24 December 2023.

During the visit, Mr. Salim Ullah interacted with the young micro-entrepreneurs, COVID-19 affected micro-entrepreneurs, apprentices and master craftspersons under the Recovery and Advancement of Informal Sector Employment (RAISE) project.

He visited young workers who have completed apprenticeship in ‘Mobile Phone Servicing’ and ‘Graphic Design and Multimedia’ under the RAISE project at their new workplace. He also visited a poultry farm under the MFCE Project. Resource Integration Centre (RIC), Sagarika Samaj Unnayan Sangstha, and Young Power in Social Action (YPSA), three of the Partner Organizations (POs) of PKSF are implementing the abovementioned projects in Feni.

News link: https://pksf.org.bd/fid-secretary-lauds-pksfs-field-level-activities/

TOT on Business Management and Entrepreneurship Development (BMED)

The ToT program on Business Management and Entrepreneurship Development (BMED) started from 02 December 2023. In order to effectively implement this training program at the grassroots and considering its long-term impacts, a series of 3-day ToT workshops was organized for 454 officials in 17 batches at the regional level. These sessions involved active participation of 276 Project Implementing Unit’s (PIU’s) officials from 69 Partner Organizations (POs) as well as 178 selected officials from the training pool of these POs.

The ToT program on Business Management and Entrepreneurship Development (BMED) started from 02 December 2023. In order to effectively implement this training program at the grassroots and considering its long-term impacts, a series of 3-day ToT workshops was organized for 454 officials in 17 batches at the regional level. These sessions involved active participation of 276 Project Implementing Unit’s (PIU’s) officials from 69 Partner Organizations (POs) as well as 178 selected officials from the training pool of these POs.

News link: https://pksf.org.bd/tot-on-business-management-and-entrepreneurship-development-held/

RAISE Coordination Meeting

A Coordination Meeting was held on 18 October 2023 with the participation of Project Implementation Unit (PIU) officials of the RAISE project POs. PKSF’s Additional Managing Director Md. Fazlul Kader presided over the meeting. At the beginning of the meeting, Mr. Dilip Kumar Chakravorty, Project Coordinator, RAISE and General Manager (Program) gave a brief presentation on the RAISE project. Besides, Mr. Golam Gilane, Manager (Program) and Deputy Project Coordinator gave a presentation on formulation of a uniform ‘Community Outreach Plan’ for selection of target project participants. In this meeting, various sessions, detailed discussions and group exercises were conducted on guidelines for conducting the apprenticeship programs, capacity enhancement program for young entrepreneurs, data collection and management for implementation of case management systems, etc. In this meeting, all the officials of RAISE Project Management Unit of PKSF were present.

A Coordination Meeting was held on 18 October 2023 with the participation of Project Implementation Unit (PIU) officials of the RAISE project POs. PKSF’s Additional Managing Director Md. Fazlul Kader presided over the meeting. At the beginning of the meeting, Mr. Dilip Kumar Chakravorty, Project Coordinator, RAISE and General Manager (Program) gave a brief presentation on the RAISE project. Besides, Mr. Golam Gilane, Manager (Program) and Deputy Project Coordinator gave a presentation on formulation of a uniform ‘Community Outreach Plan’ for selection of target project participants. In this meeting, various sessions, detailed discussions and group exercises were conducted on guidelines for conducting the apprenticeship programs, capacity enhancement program for young entrepreneurs, data collection and management for implementation of case management systems, etc. In this meeting, all the officials of RAISE Project Management Unit of PKSF were present.

Visit of the World Bank’s South Asia Regional Director

Nicole Klingen, the World Bank's South Asia Regional Director for Human Development, visited field-level interventions of the RAISE project in Savar and Dhamrai upazilas of Dhaka on 2 October 2023. She led a WB delegation that visited the RAISE project’s activities being implemented through Society for Development Initiatives (SDI) and Social Upliftment Society (SUS), two of the project-implementing Partner Organizations (POs) of PKSF.

Nicole Klingen, the World Bank's South Asia Regional Director for Human Development, visited field-level interventions of the RAISE project in Savar and Dhamrai upazilas of Dhaka on 2 October 2023. She led a WB delegation that visited the RAISE project’s activities being implemented through Society for Development Initiatives (SDI) and Social Upliftment Society (SUS), two of the project-implementing Partner Organizations (POs) of PKSF.

They visited the microenterprise of a young micro-entrepreneur. They also visited young workers who have completed apprenticeship under the project at their new workplace. They visited an orientation session of Master Craftspersons under the apprenticeship program and a courtyard meeting under the project’s outreach program. In addition, the delegates interacted with young and pandemic-hit micro-entrepreneurs supported by RAISE. “I am super pleased with what I saw today,” commented Klingen, praising PKSF’s activities in the field. RAISE really helps in the aspect of providing youth with opportunities to make more productive contribution to the economy and society in Bangladesh, she added.

During this visit, she was accompanied by S Amer Ahmed, RAISE Task Team Leader at the WB, Anika Rahman, RAISE Co-Task Team Leader, WB, Dilip Kumar Chakravorty, General Manager (Program) and RAISE Project Coordinator of PKSF, Executive Directors of the two POs and RAISE PMU officials.

Discussion Meeting on “Development of Microenterprises in Bangladesh: Role of RAISE Project

A discussion meeting titled 'Development of Microenterprises in Bangladesh: Role of RAISE Project' was organized by RAISE project Management Unit on 5 September 2023. Acting Country Director of The World Bank Bangladesh and Bhutan Mr. Souleymane Coulibaly attended the meeting as the Guest of Honour. Chairman of PKSF Dr. Qazi Kholiquzzaman Ahmad presided over the discussion meeting. Dr. Nomita Halder ndc, Managing Director of PKSF gave the welcome address.

A discussion meeting titled 'Development of Microenterprises in Bangladesh: Role of RAISE Project' was organized by RAISE project Management Unit on 5 September 2023. Acting Country Director of The World Bank Bangladesh and Bhutan Mr. Souleymane Coulibaly attended the meeting as the Guest of Honour. Chairman of PKSF Dr. Qazi Kholiquzzaman Ahmad presided over the discussion meeting. Dr. Nomita Halder ndc, Managing Director of PKSF gave the welcome address.

Visit of the World Bank Vice President

The World Bank’s Vice President (Operations Policy and Country Services) Ed Mountfield visited the field-level interventions of the RAISE project in Shariatpur district on 6 July 2023. He emphasized on the importance of supporting micro-businesses, helping people develop business skills, entrepreneurial outlook, get good jobs that give them dignity and allow them to be included in the development process; adding that the PKSF activities he visited were really impressive. During this visit he was accompanied by, among others, Md Fazlul Kader, Additional Managing Director, PKSF; Uwimana Basaninyenzi, External Affairs Advisor, the World Bank; S Amer Ahmed, Lead Economist and Program Leader, Task Team Leader (RAISE), the World Bank; Aneeka Rahman, Senior Social Protection Economist, Task Team Leader (RAISE), the World Bank; Dilip Kumar Chakravorty, General Manager (Program) & Project Coordinator, RAISE.

The World Bank’s Vice President (Operations Policy and Country Services) Ed Mountfield visited the field-level interventions of the RAISE project in Shariatpur district on 6 July 2023. He emphasized on the importance of supporting micro-businesses, helping people develop business skills, entrepreneurial outlook, get good jobs that give them dignity and allow them to be included in the development process; adding that the PKSF activities he visited were really impressive. During this visit he was accompanied by, among others, Md Fazlul Kader, Additional Managing Director, PKSF; Uwimana Basaninyenzi, External Affairs Advisor, the World Bank; S Amer Ahmed, Lead Economist and Program Leader, Task Team Leader (RAISE), the World Bank; Aneeka Rahman, Senior Social Protection Economist, Task Team Leader (RAISE), the World Bank; Dilip Kumar Chakravorty, General Manager (Program) & Project Coordinator, RAISE.

News link: https://pksf.org.bd/world-bank-vice-president-pksf-projects-really-impressive/

Discussion Meeting on Financing the Young Micro-entrepreneurs

A meeting was organized by the RAISE project to exchange views on ‘Financing the Young Micro-entrepreneurs’ on 22 March 2023. PKSF’s panel leaders, various project coordinators, senior officials and desk officers of supervising the partner organizations participated in the meeting which was presided over by Md. Fazlul Kader, Additional Managing Director of PKSF.

A meeting was organized by the RAISE project to exchange views on ‘Financing the Young Micro-entrepreneurs’ on 22 March 2023. PKSF’s panel leaders, various project coordinators, senior officials and desk officers of supervising the partner organizations participated in the meeting which was presided over by Md. Fazlul Kader, Additional Managing Director of PKSF.

The World Bank’s Implementation Support Mission

The World Bank conducted an ‘Implementation Support Mission’ from 20-30 June, 2022. The World Bank’s representatives had meeting with PKSF’s Managing Director Dr. Nomita Halder ndc, Additional Managing Director Md. Fazlul Kader and RAISE Project officials during this mission. Furthermore, the mission visited BASTOB-Initiative for People’s Self Development, one of the POs for the RAISE Project and their microenterprise program located at Atibazar and Kholamora in Keraniganj Upazila, Dhaka, in 23 June to observe the preparation for loan disbursement for the COVID-19 affected micro-entrepreneurs at the field level. Senior Economist & Task Team Leader of the RAISE Project Mr. Syud Amer Ahmed, Senior Social Protection Economist & Co-Task Team Leader Ms. Aneeka Rahman, RAISE Project Coordinator and other officials from the World Bank, RAISE Project as well as PKSF participated in the field visit.

RAISE Project Agreement Signing

The World Bank signed the Financing Agreement with Financial Institutions Division (FID), Ministry of Finance, Government of Bangladesh on 27 October 2021 to finance the RAISE project. On the same day PKSF and The World Bank signed Project Agreement of USD 250 million to implement the RAISE project. On behalf of PKSF, Managing Director Dr. Nomita Halder ndc signed the agreement. Md. Fazlul Kader, Additional Managing Director of PKSF and other project related PKSF officials were also present.

The World Bank signed the Financing Agreement with Financial Institutions Division (FID), Ministry of Finance, Government of Bangladesh on 27 October 2021 to finance the RAISE project. On the same day PKSF and The World Bank signed Project Agreement of USD 250 million to implement the RAISE project. On behalf of PKSF, Managing Director Dr. Nomita Halder ndc signed the agreement. Md. Fazlul Kader, Additional Managing Director of PKSF and other project related PKSF officials were also present.

Later, on 26 January 2022, Subsidiary Loan and Grant Agreement (SLGA) was signed between the FID and PKSF.

RAISE PMU Team Members

PKSF has formed a Project Management Unit (PMU) that is responsible for overall management of the project, capacity development of PIU and POs and monitoring the project activities along with the micro-finance program department of PKSF on a regular basis.

Sl. | Name | Designation | Mobile No | |

1 | Dilip Kumar Chakravorty | General Manager (Programme) & Project Coordinator | 01844-481325 | chakravorty21@gmail.com |

2 | Golam Gilane | Manager (Programme) & Deputy Project Coordinator | 01713-688815 | |

3 | S M Khaled Mahfuz | Deputy Project Coordinator | 01620-663344 | |

4 | Md. Tarikul Islam | Financial Management Specialist | 0196-9344050 | |

5 | Quazi Moshrur-Ul-Alam | Program Manager | 01916-136646 | |

6 | Anjuman Ara Begum | Program Manager | 01712-031513 | |

7 | Md. Faizul Tarique Chowdhury | Program Manager | 01718-031703 | |

8 | Md. Faruk Hossain | Program Manager | 01912-470474 | |

9 | Billal Hosen | Program Manager | 01703-858713 | |

10 | Md. Shahinur Rahman | Environment Specialist | 01712-029007 | |

11 | Md. Dewan Zinnah | Social Development Specialist | 01729-594951 | dewanzinnahpksf@gmail.com |

12 | Joy Ram Saha | Procurement Specialist | joysahapksfraise@gmail.com | |

13 | Noman Ibne Foysal | ICT Specialist | 01831550234 | noman.ibnefoysal.pksf@gmail.com |

14 | Ashoka Das | MIS Specialist | 01816608593 | pksf.ashoka@gmail.com |

15 | Md. Jahirul Islam | Program Officer | 01835-811626 | |

16 | Shehreen Saba | Program Officer (Communication & Knowledge Management) | 01711-363997 | |

17 | Suma Saha | Accounts Officer | 01676-207422 | sumapksf@gmail.com |

18 | Md. Atiqur Rahman | Assistant Accounts Officer | 01713-994158 | |

19 | Anamika Laskar | Assistant Accounts Officer | 01712-138252 | anamika.pksf@gmail.com |

20 | Sharmin Sultana | Assistant Accounts Officer | 01717-143301 | |

21 | Md. Samsuddin Khan | Assistant Officer | 01912-474753 |

Partner Organization

Grameen Jano Unnayan Sangstha (GJUS) Altajer Rahman Road, Charnoabad, Bhola Phone no: (0491) 62169 01914-059478, 01865-036601, 01714-059479 Email: gjus.1997@gmail.com |

Poribar Unnayon Songstha (FDA) Adarshapara, Ward no-06 Charfassion Pourashava, Bhola. Phone no: 04923-74511, 01716-185389 Email: fda.crf@gmail.com |

Community Development and Health Care Centre (CDHC) 306/2, Godown Road, Notun Bazar, Galachipa, Post & Upazila Galachipa, Patuakhali. Phone no: 01714-086583, 01726-574103 Email: fda.crf@gmail.com |

Dak Diye Jai House No. 1, Bypass Road, Masimpur, Post & Upazila: Pirojpur, Dist: Pirojpur-8500 Phone no: 01711-243388, 01733-357766 Email: info@ddjbd.org |

SANGRAM (Sangathita Gramunnayan Karmasuchi) 65, Shahid Smriti Sarak, Barguna – 8700 Phone no: 01733-347999 01720-510684 Email: sangramngo@yahoo.com |

PAGE Development Center 67/58, Nahar Plaza (7th floor) Nazrul Avenue, Kandirpar, Cumilla-3500 Phone no: (081) 76323, 77093, 01711-388410, 01712243257 Email: lokman_pdc@yahoo.com |

Community Development Center (CODEC) Codec Bhaban, Plot-02,Road-02, Lake Valley R/A Foy’s Lake, Khulshi, Chittagong-4202, Bangladesh Phone no: 880-31-2566746, 2566747, 01713100230 Email: khursidcodec@gmail.com |

Mamata House: 13, Lane: 01, Road: 01, Block: L Halishahar Housing Estate, Chattogram Phone no: 031-727295, 01707-761915 Email: mamtahq@yahoo.com |

Dwip Unnayan Songstha 24/5, Prominent Housing, 3 Pisciculture Road Mohammadpur, Dhaka-1207 Phone no: 02-9115347, 01715-475222 Email: dusdhaka@gmail.com, dus.eddus@gmail.com |

Sagarika Samaj Unnayan Sangstha Village-Charbata, P.O. Charbata, Upzilla-Subarnachar, Distirct-Noakhali Phone no: 01711-380864, 01865-041202 Email: saifulislam@yahoo.com |

Young Power in Social Action (YPSA) House: F-10 (P), Road: 13, Block: B Chandgaon R/A, Chattogram-4212 Phone no: 031-672857, 01711-825068, 01819-321432, Fax: 031-2570255 Email: info@ypsa.org, arif@ypsa.org |

Ghashful House No – 62, Road No-03, Block-B, Chandgaon R/A, Chattogram-4212, Bangladesh. Phone no: 01777-780700, 01708469443, 01819-321432, Fax: 031-2570255 Email: jafree@ghashful-bd.org |

RDRS Bangladesh House-43, Road-10, Sector-6, Uttara, Dhaka-1230 Phone no: (88-02) 58951802, 01730-328003 Email: rdrs@bangla.net |

Integrated Development Foundation House: 20, Avenue-2, Block-D Mirpur-2, Dhaka-1216 Phone no: 02-55075380, 02-55075381 Email: idf_bd92@yahoo.com |

WAVE Foundation 22/13B, Block-B, Khilji Road Mohammadpur, Dhaka Phone no: 02-55075380, 02-55075381 Email: idf_bd92@yahoo.com |

CARSA Foundation 749, Satmasjid Road Dhanmondi R/A, Dhaka-1209 Phone no: 8120634, 01713-204682 Email: carsafoundation@yahoo.com |

Gono Unnayan Prochesta (GUP) 13A/3A, Babar Road Block-B, Mohammadpur, Dhaka-1207 Phone no: 02 9138801, 01714-033373 Email: info@gupbd.org |

TMSS 631/5, West Kazipara, Mirpur-10, Dhaka-1216 Phone no: 55073540, 55073530 Email: tmsseshq@gmail.com |

Dushtha Shasthya Kendra House-741, Road-09 Baitul Aman Housing Society Adabor, Dhaka-1207 Phone no: 02-9128520, 8120965, 58151176, 01713-147392 Email: dskinfo@dskbangladesh.org |

Padakhep Manabik Unnayan Kendra House: 548, Road: 10 Baitul Aman Housing Society, Adabor Mohammadpur, Dhaka-1207 Phone no: 8151124-6, 9128824, 01713-003166, 01730-024515 Email: info@padakhep.org, padakhep@gmail.com |

Palli Mongal Karmosuchi PMK Bhaban, Vill. & Post Office: Zirabo Ashulia, Dhaka Phone no: 02-44071006 Email: humayunkabirdd@gmail.com, akmal_pmk@yahoo.com |

Pidim Foundation Plot: A-76, Road: W-1, Block-A Eastern Housing Pallabi Phase-2 Rupnagar, Mirpur, Dhaka-1216 Phone no: 01713-337670 Email: pidimfoundation.bd@gmail.com |

People’s Oriented Program Implementation 5/11-A, Block-E, Lalmatia Dhaka-1207 Phone no: 9121049, 9137769, 9122119, 01711-536531 Email:popibd-ed@yahoo.com |

Prism Bangladesh Foundation Fann Kashana, Flat: 3A/B, House: 41, Road: 6 Block-C, Banani, Dhaka-1213 Phone no: 01716-002021 Email: prismbdf@yahoo.com |

BASA Foundation House: 42, Road: 04 Preyanka Runway City, Bounia Turag, Dhaka-1230 Phone no: 01711-528281, 01730-044967 Email: islambasa@gmail.com |

BASTOB-Initiative for People’s Self Development House #549, Road#10, Baitul Aman Housing Society, Adabor, Dhaka-1207. Phone no: 02-48112102, 02-48112402, 01713-004009 Email: bastobbangladesh@gmail.com, info@bastob.org |

BEDO Rahman Lucid Tower D-2, 19/3 Kakrail, Dhaka-1217 Phone no: 58316851, 01985-503551 Email: bedoco1993@gmail.com |

Village Education Resource Centre (VERC) B-30, Ekhlas Uddin Khan Road Anandapur, Savar, Dhaka-1340 Phone no: 88-02-7745412, 01713-030885 Email: info@vercbd.org |

Resource Integration Centre (RIC) House:88/A/KA, Road-7/A Dhanmondi R/A, Dhaka-1209 Phone no: 880-2-58152424, 01711-548790 Email: ricdirector@yahoo.com |

Shakti Foundation for Disadvantaged Women House: 4, Road: 1, Block-A Section-11, Mirpur, Dhaka-1216 Phone no: 02-8810700, 01819-218267 Email: info@sfdw.org |

Centre for Community Development Assistance (CCDA) House no-1/8 (Block-G) Lalmatia Housing Estate, Mohammadpur, Dhaka-1207 Phone no: 8711215, 8713137, 01714-161650 Email: ccdabd@gnbd.net, ccdacor@gnbd.net |

SHEVA Nari O Shishu Kallyan Kendra 84, Kazi Nazrul Islam Avenue Tejgaon, Dhaka-1215 Phone no: 9114497, 01711-560065 Email: sheva@bol-online.com |

Society for Development Initiatives (SDI) House: 2/4 (5th floor), Block-C Shahjahan Road, Mohammadpur, Dhaka-1207 Phone no: 02- 9122210, 02- 9138686, 01711-815053, 01730-330703 Email: sdi.hoffice@gmail.com |

Society for Project Implementation Research Evaluation & Training (SOPIRET) 8/1, Segun Bagicha, Silsila Villa, Apartment No: C/903, Dhaka Phone no: 9559295, 01742-614151 Email: sopiretdhaka@gmail.com, sopiret@gmail.com |

Social Upliftment Society (SUS) C-25, Jaleshwar, Shimultala, Savar, Dhaka-1340 Phone no: 7742403, 7746229, 01678-678877 Email: sushelp360@gmail.com |

HEED Bangladesh Main Road, Plot: 19 Block-A , Section-11 Mirpur, Dhaka-1216 Phone no: 9004556, 9001731 Email: heed@agni.com |

Amra Kaj Kory (AKK) Rowshonara Manzil, House # 0004/18, Bindaboner More, North Tepakhola, Post Office: Faridpur Thana: Kotwali, Zilla: Faridpur. Phone no: 0631-63944, 01731-187569, 01712-001233, 01719-628883 Email: amrakajkory@yahoo.com |

Society Development Committee (SDC) Zaman Manzil, Road No-1, Goalchamot Faridpur Sadar, Faridpur-7800 Phone no: (0631) 65854, 01714-022987 Email: sdc.bangladesh@yahoo.com |

Gono Kallayan Trust (GKT) 19-20, Adorsa Chayaneer Housing Society Ring Road, Shyamoli, Dhaka-1207 Phone no: 01711-547780, 01733-076000 Email: gkt@bdcom.com, gktmfi@yahoo.com |

SDS (Shariatpur Development Society) Tulasar, Sadar Road, Shariatpur-8000 Phone no: (0601) 61654, 0175446907 Email: sds.shariatpur@gmail.com |

Naria Unnayan Samity (NUSA) Post & P.S: Naria, Shariatpur-8020 Liaison office: House no: 429, Road No: 30, 5th floor Mohakhali DOHS, Dhaka Phone no: (0601) 59154, 01718-239744 Email: nusa_bd@yahoo.com |

Aungkur Palli Unnayan Kendra Village: Sreenathdi, P.O.: Dattakendua Upazila & District: Madaripur Phone no: 01711548762, 01650290190 Email: aungkur@aungkurbd.org |

Bangla-German Sampreeti (BGS) 4/16 (1st Floor), Block-B, Humayun Road, Mohammadpur, Dhaka-1207. Phone no: 01322-900101, 01716-196473 Email: bgs.info1990@gmail.com |

Centre for Development Innovation and Practices House No. 22/9, Block-B, Babor Road, Mohammedpur, Dhaka-1207 Phone no: 01713-333186, , 01313-030434 Email: mifta.huda@cdipbd.org |

Coast Foundation House no 13 (1st floor), Road no# 2, Shyamoli, Dhaka Phone no: 01711-529792, 01713-328815 Email: reza@coastbd.net |

Sajida Foundation OTOBI Center (6th floor), Plot-12, Block- C W S (C), Gulshan South Avenue Gulshan-1, Dhaka-1212. Phone no: 01819-212310, Email: sajida@sajidafoundation.org |

South Asia Partnership- Bangladesh House # 63, Block- ‘Ka’, Mohammadpur Housing, Pisciculture & Farming Cooperative Society Ltd., Shyamoli, Mohammadpur, Dhaka-1207 Phone no: 01720-200030, Email: edsapbd@gmail.com |

KPUS (Kushtia Palli Unnayan Sangstha) 18/5, 1 no Masjid Bari Lane Aruapara, Kushtia-7000 Phone no: (0601) 59154, 01718-239744 Email: nusa_bd@yahoo.com |